The Australian dollar is a “risk” currency while the yen is a “safe haven”. This makes moves quite sharp, and now the team at Barclays sees opportunities:

Here is their view, courtesy of eFXnews:

We expect China’s PMI to remain in contraction territory and anticipate a below-consensus decline in the Caixin PMI (48.0, versus consensus 48.1, previous 48.2). Weaker data from China are likely to weigh on China-exposed currencies such as AUD. On the other hand, although we expect no rate cut at the RBA’s meeting, we believe that the weak inflation outlook and the relative overvaluation of AUD will require easier financial conditions and see a risk that RBA rhetoric will be tilted toward an accommodative bias.

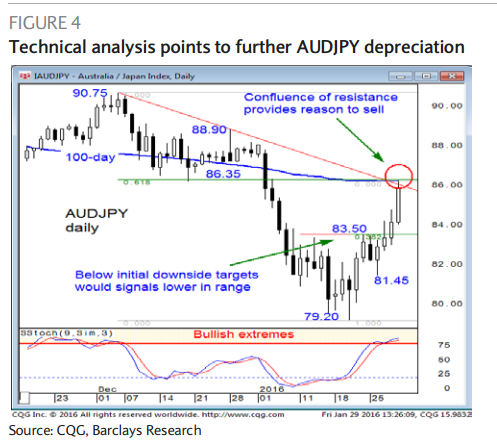

From a technical perspective, we are overall bearish for AUDJPY. Given the stretched condition of daily momentum studies, we would prefer to use counter-trend upticks as an opportunity to sell at better levels. A confluence of resistance in the 86.35 area provides nearby selling interest. A move below our initial downside targets in the 83.50 area would encourage our bearish view for a move lower in range toward next targets near 81.45.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.