Draghi dragged the euro down, but it didn’t go too far. Nevertheless, it is now approaching an interesting technical level and so is GBP/AUD. Here is the view from SocGen:

Here is their view, courtesy of eFXnews:

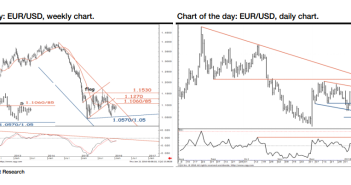

Having broken below the flag formation, EUR/USD retested last March lows and it continues to sustain below 20 week MA and more importantly below a multiyear descending channel limit at 1.1060/85, notes SocGen.

“It is noteworthy that this level also corresponds to the right shoulder of a Head & Shoulders pattern. Weekly MACD indicator is still languishing in negative territory which suggests possibility to continue the downtrend.Thus, 1.1060/85 remains a key resistance and will decide if a larger rebound takes shape,” SocGen adds.

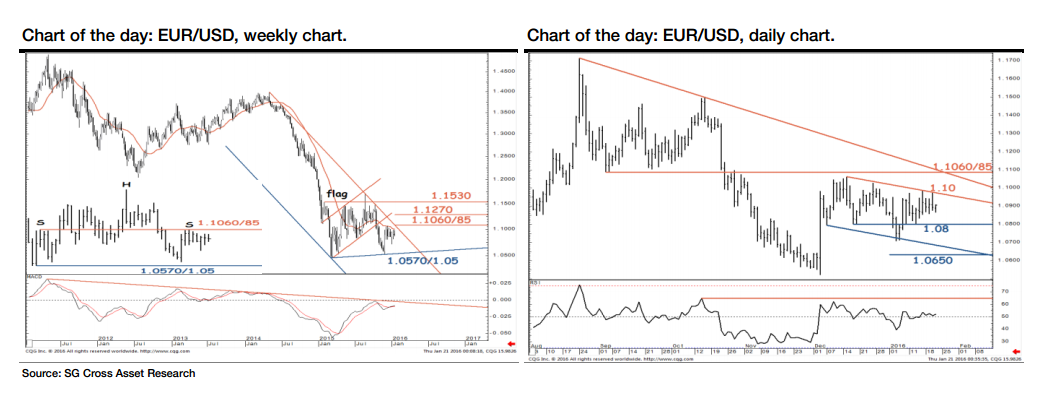

“If we drop down to daily chart, the pair is undergoing a choppy down move within a mildly descending channel. Channel limit at 1.10 is an immediate resistance.

A clear break below December lows of 1.08 will indicate possibility to test 1.0650 and even the neckline of the aforementioned pattern at 1.0570/1.05, SocGen argues.

Turning to GBP/AUD, SocGen notes that after testing the lower limit of a multiyear channel (2.00), GBP/AUD has showed some signs of a recovery.

“At 2.00, it has also completed the 23.6% retracement from 2013 lows. Monthly RSI is hitting a graphical support highlighting 2.00 as a key level. Formation of a weekly bullish engulfing pattern at that level gives further credence to the support.

On daily chart, recent consolidation appears to be tracing a probable inverted H&S with neckline at 2.10. With daily indicator at support, a recovery is more likely initially towards 2.10.

A break above will lead to extension in up move towards 2.14/2.17, the 61.8% retracement from August highs,” SocGen projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.