The common currency is behaving as a “safe haven” one, but not 100% of the time. It sometimes remembers the reasons for the “funding currency” status – easy ECB policy, which could strike again. What’s next? Here is the view from Credit Agricole:

Here is their view, courtesy of eFXnews:

Relative to other safe haven assets like JPY and gold, EUR has struggled to perform despite the latest spike in risk aversion.

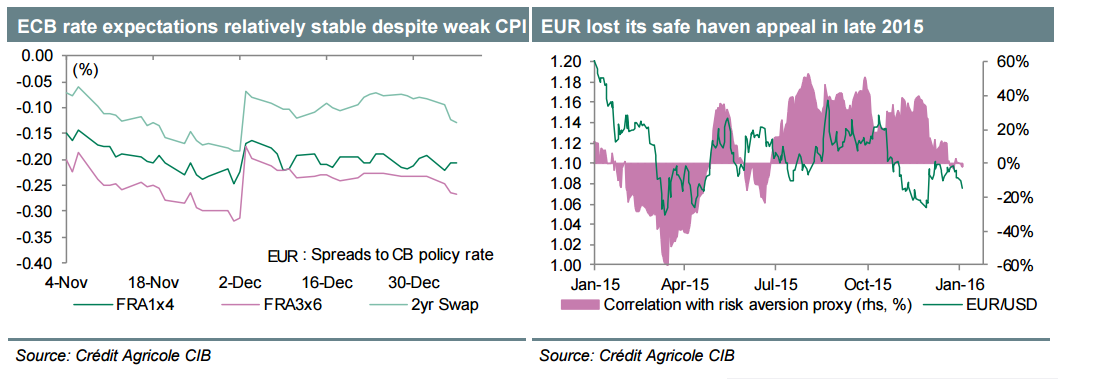

Part of that may be due to the weaker than expected flash HICP inflation print for January. That said, the rate markets do not seem to expect much to come from the ECB when it meets again on 21 January.

This week, only the ECB December minutes would have a more meaningful impact on the markets, especially if they highlight that the bank’s easing bias remains in place.

Market sentiment should remain a driver as well even if EUR has not benefited that much from the latest bout of risk aversion. Indeed, it seems that the single currency ‘lost’ some of its safe haven status late last year.

If anything, we suspect that EUR could benefit from a further deterioration in market risk sentiment but that resilience will manifest itself mainly against less liquid, riskcorrelated G10 currencies.

The risks for EUR/USD should remain on the downside in our view.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.