Recent market turmoil resembles what we’ve seen back in August. That led to a postponement of the rate hike. Will the Fed react again? The team at Credit Agricole explores:

Here is their view, courtesy of eFXnews:

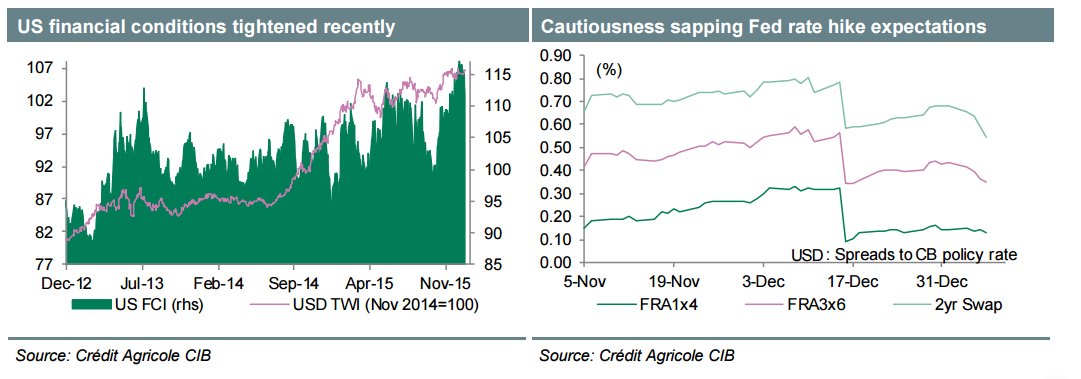

Risk aversion reared its ugly head yet again at the start of the new year with concerns about the economic and market outlook for China as well as geopolitical risks spooking the markets. Concerns are growing that the deteriorating global economic outlook and growing market uncertainty would lead to unwarranted tightening in US financial conditions and force the Fed to adopt a more cautious stance yet again. Needless to say, this could deal a blow to the USD decoupling trade.

We recognise that risk and stand ready to adjust our tactical USD-view correspondingly.

There is little to suggest, however, that the Fed is on the verge of reconsidering its policy outlook and the upcoming Fed speeches will confirm that.

In addition, next week’s US retail sales could corroborate the view that the domestic demand driven recovery in the US remains in place. All that should keep USD supported for now.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.