Oil prices have been in the center of attention, with both Brent and WTI Crude trading at levels last seen in 2004. What if this goes all the way to $20? Here is the view from Olivier Korber at SocGen:

Here is their view, courtesy of eFXnews:

“Tensions in the Middle East between Saudi Arabia and Iran, the threat of a nuclear test by North Korea, weak China PMI and the PBoC accelerating the yuan depreciation are all undermining market risk appetite. This puts the commodity complex under pressure. Our latest ‘Oil Drivers: There will be blood’ underscores the huge global oversupply situation and the current overwhelmingly bearish sentiment.

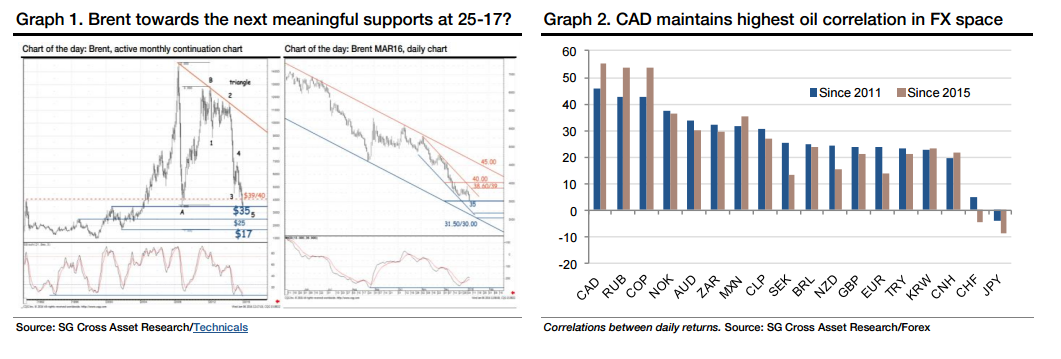

The fall in Brent prices accelerated to new lows this week, breaking the double bottom at 37 tested in 2004 and 2008 (Graph 1). Our technical analysts signal that “Brent is now probing the multi-year level of $35 which remains a decisive factor as far as long-term charts are concerned. The down move would extend towards $31.50 (projected target in log) and possibly even towards $17 (projected target in linear term) which also coincides with 2001 lows”. A worst case risk scenario seeing Brent prices heading towards $20 in discounting a new oil paradigm cannot be totally ruled out.

FX far from insulated. At the same time, oil sensitive currencies are naturally feeling the pain. The USD/CAD effortlessly broke its psychological resistance at 1.40, the USD/NOK is edging to 9.00 for the first time since 2002, while the RUB again is facing extreme dislocations. The CAD robustly maintains the highest oil correlation in FX space over time (Graph 2). The recent fall may be a source of concern for investors exposed to pain thresholds in currencies which are now trading in unchartered territories. As such, they may find interest in considering hedging a risk scenario until better days. With this perspective in mind, leveraged hedging solutions can be implemented via FX options.

We recommend Buying a 3M USD/CAD call spread strike 1.42/1.46, which becomes zero cost in setting a knock-out barrier on the long call at 1.51. The probability of hitting the barrier is less than 10%.”

Olivier Korber – SocGen

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.