The Canadian dollar suffered with oil prices but didn’t really recover when they recovered. What’s next?

Here is the view from Nomura:

Here is their view, courtesy of eFXnews:

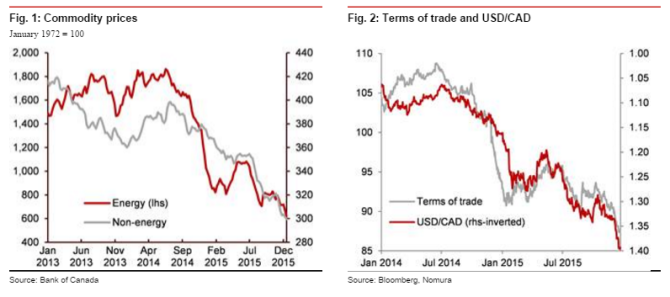

“The Canadian dollar has depreciated significantly in recent weeks. Most of the depreciation can be linked to the further decline in oil prices and, to a lesser extent, to an increased probability of a rate cut by the BoC.Using our valuation model for USD/CAD, we estimate that USD/CAD should be closer to 1.35, given current commodity prices and rates differential.

We also look at the impact of various scenarios on USD/CAD fair value and find that commodity prices would need to decline by another 20% for USD/CAD fair value to increase above 1.40.

This suggests that, unless commodity prices continue to decline, further increases in USD/CAD are likely to be limited at this point, unless the Canadian economy falters. The Canadian dollar has depreciated sharply in recent weeks, losing more than 4% against USD, as oil prices continue to decline leading to a deterioration in the terms of trade. Moreover, a string of weaker data and the lower commodity prices have increased the market pricing of the probability of a rate cut by the Bank of Canada.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.