After 2015 has seen significant movements, it’s time to look to 2016, which is just around the corner.

Here are the views on major pairs from Deutsche Bank:

Here is their view, courtesy of eFXnews:

GBP/USD:

“In 2016, the GBP is likely to remain vulnerable most obviously against the USD. The pound in particular should suffer from a mix of fiscal contraction constraining the BOE tightening cycle, making a C/A deficit of near 5% of GDP more difficult to finance, most especially in the face of ‘Brexit’ uncertainties. In 2016/7, Cable is expected to test and likely break the 1.35 – 1.40 bottom end of the range that has prevailed for 30 years,” DB projects.

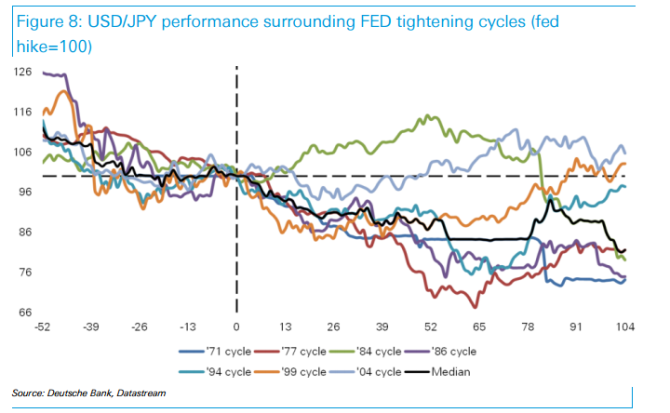

USD/JPY:

“We anticipate that when the USD shows toppish tendencies, the JPY will take the lead, in much the same way is it was at the forefront of the USD resurgence that started in late 2011. Even if the yen does not quite conform to the past pattern of strengthening in Fed tightening cycles, the yen will outperform almost all other currencies barring the USD in 2016, with a USD/JPY peak just shy of Y130,” DB argues.

EUR/USD:

“2016 year-end forecasts have changed slightly, while end-2017 forecasts are largely unchanged. EUR/USD is now forecast at 0.95 at the end of 2016, up from our original 0.90 forecast, in recognition of: i) some prospective impact that risk factors like China will have in restraining Fed expectations holding back the USD versus the majors as described above; and, ii) EUR/USD is set to end 2015 slightly above our original projections, setting a higher EUR/USD starting point for future forecasts,” DB adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.