GOLD recently struggled to break the $1320 level and traded lower towards the $1295 support area. It looks like it is consolidating as of writing, and waiting for a catalyst for the next move. There are a couple of important economic releases lined up later during the New York session, including the US consumer price index data, building permits figure and housing starts data. The US CPI outcome might have a huge impact on GOLD prices. The market is expecting the US CPI be to around 2%, compared to the last reading of 2.1%.

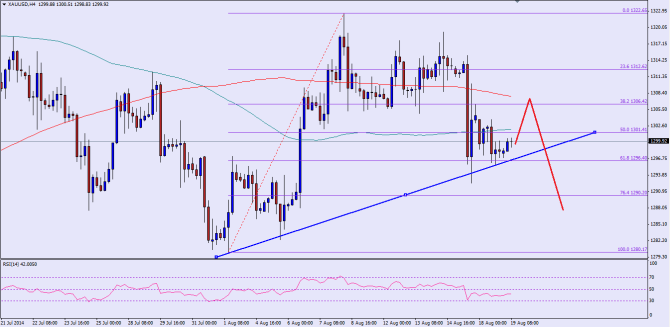

There is an important bullish trend line formed on the 4 hour chart for GOLD. The recent fall in GOLD stalled right around the mentioned trend line. However, recovery after that is not convincing, which means there is still a risk of breakdown in the short term. If GOLD sellers manage to break the trend line and support area, then it is possible that the prices might fall towards the last swing low of $1280. Any further losses might take GOLD towards the $1260 support area. The 4H RSI is below the 50 mark, which adds value to the bearish view moving ahead.

Alternatively, if GOLD buyers manage to take the prices a bit higher from the current levels then they might face resistance around the 100 moving average, followed by the 200 moving average. There are several resistances on the way up for GOLD, which means selling pressure remains intact in the near term.

Overall, selling rallies remain a good option considering the upcoming risk event. $1320 is a major hurdle for GOLD on the upside.

————————————-

Posted By Simon Ji of IKOFX