The Euro is trading lower against many major currencies, including the Australian dollar. The German and French GDP data were published on Thursday. Both the events were not in the favour of the Euro. The French GDP was expected to rise by 0.1%, but came in at 0%.

Similarly, the German GDP was expected to decline by 0.1%, but it declined by 0.2%. The outcome was not on the positive side for the Euro. This might impact the EURAUD pair in the coming session, and there is a chance of it trading lower.

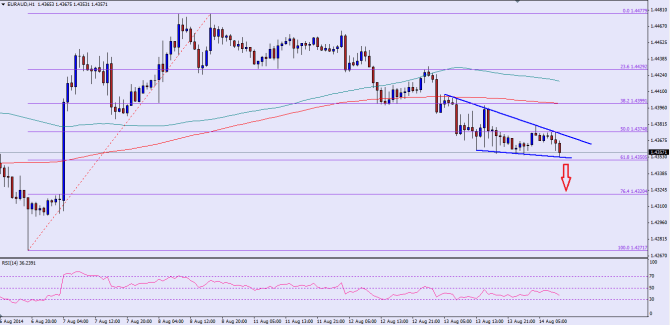

There is an important wedge pattern forming on the hourly chart for the EURAUD pair, which is protecting the downside in the pair as of now. The wedge support can be seen around the 1.4350 level. The mentioned level also coincides with the 61.8% fib retracement level of the last move higher from the 1.4271 low to 1.4477 high.

So, technically the 1.4350 level holds a lot of importance for the pair in the short term. If the pair breaks the support area, and closes below the wedge, then it might open the doors for further downside acceleration in the pair. In that situation, the pair might fall towards the last low of 1.4271.

On the upside, initial resistance can be seen around the wedge upper trend line around the 1.4373 level. A break and close above might call for more gains towards the 200 hourly moving average, followed by a test of the 100 hourly moving average.

Overall, the chance of a break lower is more compared to the move higher as the market sentiment favours the Euro sellers moving ahead.

Posted By Simon Ji of IKOFX