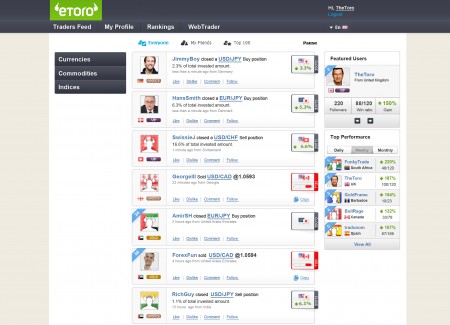

eToro, a trading platform that emphasizes friendliness and simplicity, launched a social network for its traders. Here’s a review of OpenBook.

Traders can opt in to share their trades with everybody or keep them to themselves. This is similar to Currensee’s sharing scheme. eToro’s simplicity is seen here – no option to share trades only to friends.

Users of this system can not only share their trades and connect to others, but also follow successful traders in real time, copying their moves. This could be good for those traders that don’t have enough time to trade and see forex as an investment.

Yet again, OpenBook’s simplicity is sometimes too simple – the tools for finding those good traders aren’t very sophisticated – no risk factor, as Michael Greenberg writes in his review.

Despite these shortcomings, and the fact that the platform is naturally limited to eToro traders only, this initiative is still great. The trades are shared on the web. Anyone can go to the site and see what’s going on without registering or opening an account.

Many market-making brokers such as eToro rely on their traders to wipe out their accounts, and trade against them. By enabling traders to see others’ moves and especially follow them, there’s a potential for reducing the terrible loss ratio for forex accounts, meaning that eToro will indeed profit from spreads.

The social forex scene is recently bubbling. FXBees recently joined Currensee. Everybody is going transparent these days, but the methods vary. I’ll review it later on this week.