Commodity currencies have struggled between their internal strengths and the falling prices of commodities. What’s next?

Here is the view from CIBC on the Canadian and Australian dollars:

Here is their view, courtesy of eFXnews:

The following are CIBC’s latest weekly outlook for the CAD and AUD.

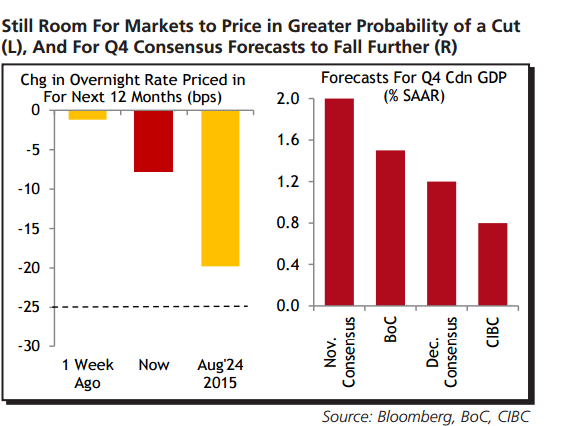

Loonie to Languish Longer: As the economy rebounded in Q3, markets moved to price out the possibility of a further BoC interest rate cut. That helped support the loonie even as oil started to slide. However, that’s changed in the past week, with poor September GDP, November employment and October trade figures suggesting that the economy continues to struggle. That’s seen markets price in a greater probability of another interest rate cut and seen the consensus trim its forecast for Q4 GDP. But there’s probably more downgrades to come. And even though we don’t forecast a rate cut, markets could certainly price in a greater probability of one which would weigh on the loonie.

We recently changed our forecast to see a further depreciation in CAD to 70 cents (USDCAD 1.42) in Q1 2016.

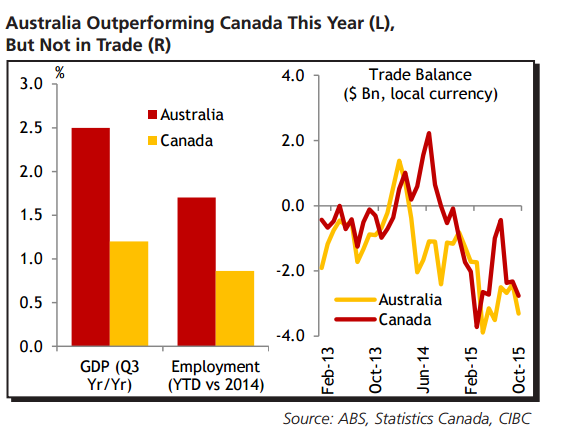

Aussie Appreciation Overdone: The A$ has recovered from below 0.70 against the greenback to around 0.74, and is one of few currencies to be up against the greenback over the past month. It’s true that the Australian economy has held up better than we would have expected so far this year, particularly in comparison to Canada, given Australia’s more resource-orientated economy. However, the trade deficit in Australia is deteriorating as quickly as Canada’s, and there’s likely room for sentiment on the Australian economy to turn again.

We see AUDUSD falling to 0.70 in Q1, although we no longer see AUD depreciating against the loonie due to our downgraded assessment for CAD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.