The Australian dollar rattled and rolled, enjoying the blockbuster jobs report but with some seeing a short AUD/USD trade.

The team at Credit Suisse dive into a sector sometimes overlooked in the land down under: housing.

Here is their view, courtesy of eFXnews:

Australia’s housing market has been one of the country’s few bright spots in recent years, providing a much needed offset to the falling terms of trade and soggy mining sector, notes Credit Suisse.

“However, the APRA’s macro-prudential measures have contributed to a tightening in lending conditions and residential auction clearance rates have started to move lower.

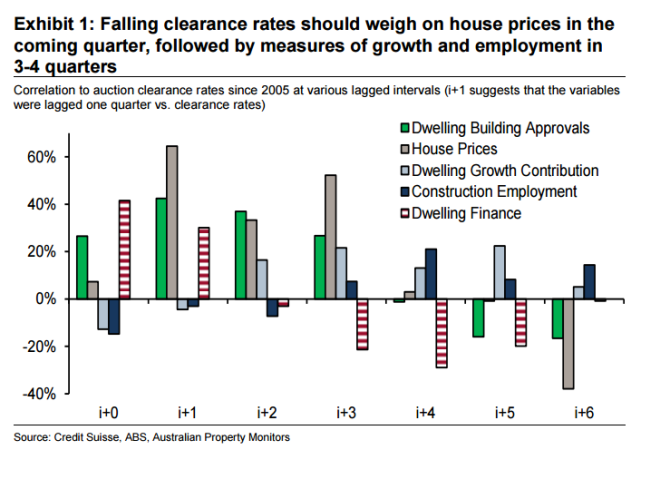

We estimate that the decline in clearance rates could start to weigh on house prices in the coming quarter and measures of growth and employment in 3-4 quarters.

Having contributed materially to growth and inflation in recent years, a slowdown in the housing sector would keep the RBA biased for additional easing in the months to come,” CS argues.

“We remain structurally bearish AUDUSD and maintain our forecast set at 0.69 in 3 months and 0.66 in 12 months,” CS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.