The Australian dollar enjoyed better employment data, among other events, to move higher.

Nevertheless, in the bigger picture, the team at Deutsche Bank sees room for the downside:

Here is their view, courtesy of eFXnews:

In a note today, Deutsche Bank advises clients to consider entering strategic short AUD/USD position from here targeting a move to 0.60 by the end of the next year.

“Australia is suffering from an income recession. The primary transmission channel for the terms-of-trade shock is mining investment, rather than net exports.

Only improvement in the external account, however, can prevent the income recession from feeding into a growing output gap and greater disinflation in 2016. That requires a substantially weaker exchange rate.

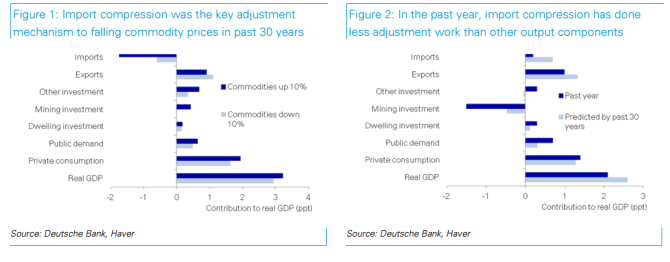

We show that excessive imports are the main drag on output. The RBA hopes for rising domestic consumption ratios, but much additional spending will leak abroad and widen the trade deficit, in the absence of an improbably fast recovery in exports. At a time of declining investment and FDI inflows, we argue that Australia can ill afford to finance a widening current account deficit through debt-generating inflows. Reducing the output gap and unemployment through consumption therefore requires significant further depreciation so that import substitution stabilizes the external account.

We estimate that a narrowing output gap with unemployment permanently at 5.9% requires the TWI to weaken by up to 10%, in line with fair value on our BEER model. This should also be the primary reflationary channel,” DB says as a rationale behind this call.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.