The Australian dollar is trading a touch higher against the New Zealand dollar. This has more to do with the New Zealand dollar weakness compared to the Australian dollar strength, as the AUDUSD has also declined recently.

It looks like that the RBNZ intervention card played out well, as the New Zealand dollar has moved a lot lower against most of its counterparts, including the Australian dollar. The AUDNZD pair has climbed recently, and it looks like that the pair might continue surging higher if the New Zealand dollar keeps declining.

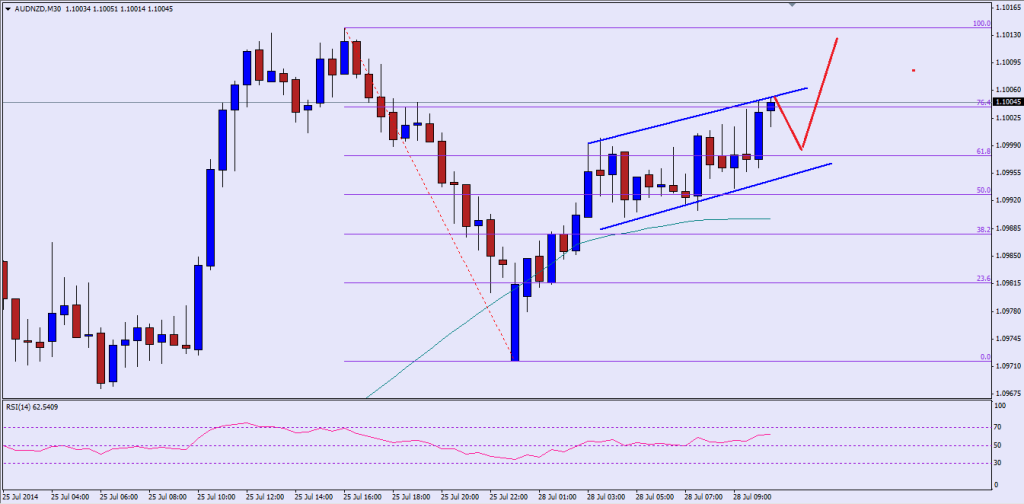

There is an uptrend channel forming on the 30 minute chart for the pair. As of writing, the pair is testing the channel resistance trend line which is also coinciding with the 76.4% fib retracement level of the last drop from the 1.1014 high to 1.0971 low. The RSI is also approaching the extreme levels, so the pair might dip a few pips from the current levels before it can continue trading higher. If the pair breaks higher, then a break of the previous high at 1.1014 is possible in the short term. A break above the same might expose the 1.1035 high moving ahead. The pair is trading above the 100 moving average on the 30 minute chart, which is a positive sign.

Alternatively, if the pair fails to trade higher and breaks the channel support trend line, then a test of the 100 moving average would be on the cards. Any further losses should find buyers around the 1.0968 low, which is a critical short-term support level and must hold if the pair has to continue trading higher.

Overall, buying dips look like a good option moving ahead.

————————————-

Posted By Simon Ji of IKOFX