The Chinese authorities pushed for and received acknowledgement from the International Monetary Fund, and the yuan is now included in the IMF’s SDR.

The rearrangement of SDR exposes one important currency which has a diminishing role.

Here is their view, courtesy of eFXnews:

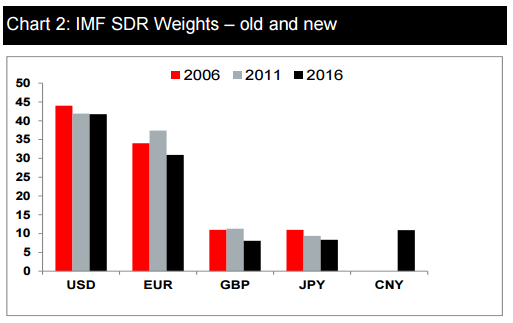

On Monday, the IMF announced that China’s renminbi (CNY) will, from 1 October 2016, form part of the IMF’s Special Drawing Rights (SDR). This likely has few if any immediate implications for either the four existing G10 SDR currencies – USD, EUR, JPY and GBP – or those G10 currencies that sit outside the SDR basket, including the AUD.

What the inclusion of the CNY and re-weighting of the four currencies in the existing basket does do, is underscore the diminishing role that the euro plays in the composition of global FX reserves.

In short, the USD’s share has not changed since it remains the pre-eminent global reserve currency by a large margin (and whose share is rising). Sterling’s share should arguably have fallen further, while the even smaller fall in the JPY – bearing in mind its very small global reserves weight – might be partly a sop to Japan in acquiescing to China’s inclusion in the SDR.

The big fall in the euro’s share appears to reflect the reality of its role in global reserves falling not risen – a trend evident since the first Eurozone crisis back in 2011. In a world of falling not rising global FX reserves, expect Reserve Managers’ activity to remain a headwind not tailwind for EUR. This is especially so if we do see a (likely gradual) pick-up in CNY holdings.

The AUD also stands to be a potential loser in such a process, to the extent that AUD has been held in part as a CNY proxy. We don’t overplay the latter however, bearing in mind the small difference in the share of global FX reserves enjoyed by the AUD relative to the likes of CAD.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.