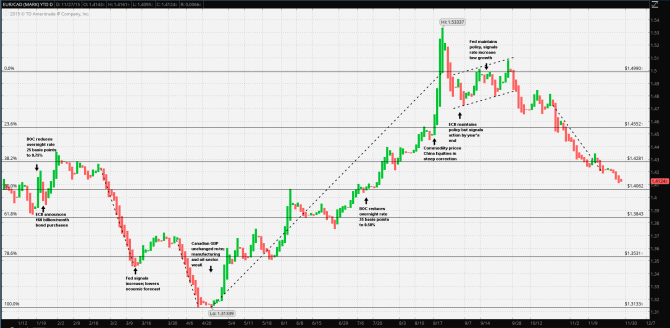

The Canadian Dollar saw its best against the Euro towards the end of April of this year at $1.31339 vs the Euro. The Loonie had steadily gained against the Euro in the days leading to and following the initiation of its expanded asset purchase program, 9 March. The Bank of Canada had reduced its key policy rate several weeks before to 0.75% from 1.00%. The year’s high for the pair was $1.4358 per Euro attained on 30 January. From there the Loonie gained 6.289% to $1.3455 per. A small retracement followed, the Loonie giving up just under 2% before resuming its trend lower, reaching $1.31339 on 23 April; just over 8.5% since 30 January.

It should be noted that the 2% ‘bounce’ that occurred between 13 March and 30 March coincided with the US Fed mid-March meeting at which the Fed indicated the necessity of raising rates and at the same time downgrading its growth and inflation expectations for the US economy.

Guest post by Mike Scrive of Accendo Markets

It should be noted that as one of the three NAFTA members, Canada shares a strong bilateral trade relationship with the US. Well over 70% of Canada’s exports, including mineral resources as well as a bilateral manufacturing trade with the US auto and aerospace industry. Hence, a stronger US Dollar has the potential to generate increased demand for Canadian exports. This in turn supports the Loonie by relieving the pressure on the BOC to ease policy to stimulate growth. Hence, it’s reasonable to conclude that a stronger US economy leads to a stronger Loonie.

However, the Fed clearly gave mixed signals and maintained policy; yet the Loonie continued to strengthen against the Euro. This would then indicate that the trend was more a function of the Euro than the Loonie. Indeed, with the expanded asset purchase program well under way, the ECB faced a new crisis with the impasse between the European Commission and the new Greek government. The looming crises created a flight to quality trade in non-Eurozone nations, driving yields well below zero thus pushing investors further out on the risk curve. For example Norges bank purchased Nigerian debt; Allianz increased its allocation of mortgage backed bonds; JP Morgan increased purchases of lower grade corporates. It’s not unreasonable to assume that the strength of the Loonie was driven by Canada’s positive yields and AAA credit rating.

After reaching its 2015 best against the Euro, the Loonie began a four month weakening trend in spite of the problems in Europe. First, crude petroleum, one of Canada most significant export showed no signs of price recovery; second, Canadian GDP demonstrated no significant improvement; third, the US Fed, again, downgraded its economic outlook at the April policy meeting putting in doubt the health of the US economy as well as a 2015 rate increase; lastly, there were encouraging signs over the Greek debt impasse.

The Loonie weakened to $1.4037 from $1.31339, 6.876% by the time the BOC convened its 15 July meeting, at which it was decided to reduce the key policy rate 25 basis points to 0.50%. It should be noted that in the weeks preceding the meeting, the Loonie had stabilized $1.3831 support to $1.4062 resistance. After the rate reduction the trend resumed. Hence, it’s reasonable to conclude that it was more a matter of Loonie weakening rather than Euro strengthening. Indeed, this may have well been the case as the Loonie plummeted from $1.4491 to $1.53337, 5.82% along with oil and Asian equity markets. All told, from the April high of $1.31339 to 25 August low, the Loonie lost 16.75%. The motif had completely changed: from capital inflows due to negative yields earlier in the year, to that of commodity driven capital outflows.

It just so happened that at the lowest point for the Loonie, the ECB began to signal that a further expansion of the asset purchase program might be needed to prevent an increasingly deflating Euro. At the mid-September US Fed meeting, the signals again seemed contradictory, with the Fed indicating a ‘lift off’ the zero bound, but at the same time expecting moderate growth and concerns about global headwinds: “…Recent global economic and financial developments may restrain economic activity somewhat and are likely to put further downward pressure on inflation in the near term…”

It was at about this point that the Canadian Dollar finally regained its footing vs the Euro and has since regained 7.3% from the low to $1.4210 per.

The question becomes what may be expected from here? All indications point to a Fed key policy rate increase, which wouldn’t necessarily be bad for the Canadian economy. However, with the recent terrorist attacks in Paris followed by potential threats of more, an unorganized global policy to contain these threats, (including an incident with a Russian aircraft), haltingly slow US economic growth, no letup in oil production or improving demand for industrial commodities all may contribute to a slowing in global economic growth. It’s important to note that with a key policy rate already at 0.50%, and global commodity prices at record lows, a further rate reduction would do no good. Hence, as long as the Canadian economy can count on even moderate demand from its main trading partner, and should the ECB ease further, the Loonie should be able to hold its ground and possibly gain on the Euro, depending on the scale of the next ECB policy action.

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”