EUR/USD dipped to lower ground but bounced back to a higher range.

The team at Citi explains why staying short is the way to go, with 5 reasons:

Here is their view, courtesy of eFXnews:

There are 5 good reasons all round for the EUR to weaken with particular focus on EUR/USD, says CitiFX in a note to clients today.

“Market: Interest rates, particularly at the short end of the curve, in Europe and the US are moving in opposite directions.

Policy: The ECB and the Fed are facing opposite directions. The ECB needs to achieve more with its Q.E., particularly a lower exchange rate as Draghi well knows. The Fed needs to overcome its fears and hike rates so it is not further behind the curve.

Techamentals: European data has not improved enough and inflation is still too low. On the other side, US data is strong.

Trade: The slowdown in the East, particularly China, is a current threat to German activity. Granted that China also needs a weaker currency (or at least not a stronger one) which means the USD should be set to outperform on a wider scale.

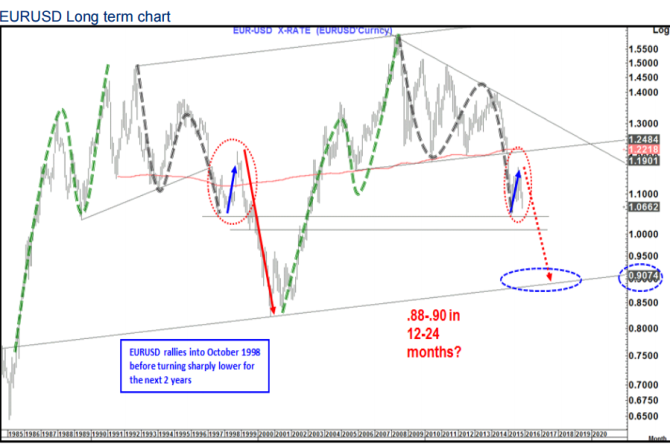

Technical: The price action is still similar to that seen in 1998-99 – also a period where the ECB and the Fed were facing opposite directions. The trend lows are not far now and a breach of 1.0458 would be important when seen,” Citi argues.

In line with this view, Citi maintains a short EUR/USD position from 1.1110, with a stop at 1.1520, and a target at 1.0450.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.