EUR/USD certainly lost a lot of ground in the past 18 months, but perhaps there’s lots more.

Sebastien Galy at Deutsche Bank analyzes the yield impacts:

Here is their view, courtesy of eFXnews:

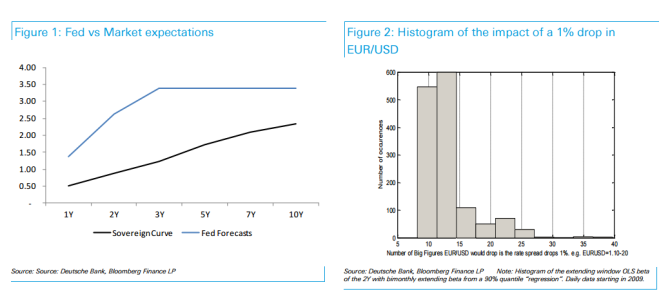

“Even though the rates market prices in the forward path of the Fed, we find that EUR/USD ignores it and prices it only as a function of the yield differential. We find that a 1% drop in the yield differential leads to a 10 to 15 big figure drop in EUR/USD.

“If expectations of Fed tightening only increase at the pace priced into the forward rate, it should drive EUR/USD lower as the market trades it as a function of the 2 year sovereign spread and not its forward path. If in addition, the Fed’s dot forecast is anywhere close to correct the move in both yields and the USD would be theoretically considerable as EUR/USD drops 15 to 20 big figures for a 1% drop in the rate differential.

We find that the FX market trades EUR/USD as a proxy for 2Y sovereign rate differentials far more so than any other maturity. The significance of the 2Y spread is quite robust to a variety of models, time periods and frequencies from daily, to monthly and quarterly. The forward path of the two year on the other hand proves at best of secondary importance and is rarely statistically significant.

Based on the current pricing of the relative forwards, EUR/USD is set to slowly drift lower over the next few years.”

Sebastien Galy, Macro Strategist – Deutsche Bank

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.