EUR/USD has been hit by the superb NFP. But what about the other side of the equation?

Here is the view from Credit Agricole:

Here is their view, courtesy of eFXnews:

EUR’s precipitous slide of late may have weakened the case for imminent ECB action.

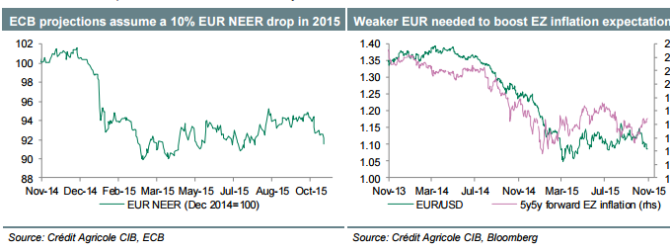

To evaluate this argument, we note that as part of the September staff macro projections, the ECB assumed that the EUR NEER will depreciate by close to 10% in 2015 (the March lows).

This would imply further downside for the EUR-crosses from here before we reach a level that could rule out a depo rate cut on 3 December.

The policymakers should keep markets betting on further monetary stimulus, given that, despite their recent recovery, gauges of Eurozone inflation expectations remain close to multi-year lows.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.