The pound was certainly hit by the recent downgrade of inflation forecasts by the BOE. For cable, another blow came from the excellent NFP in the US.

And their may be more to come:

Here is their view, courtesy of eFXnews:

In a recent note, Deutsche Bank advises clients to turn outright bearish on GBP arguing that the rationale for being long sterling has disappeared. DB outlines 3 main reasons behind this call:

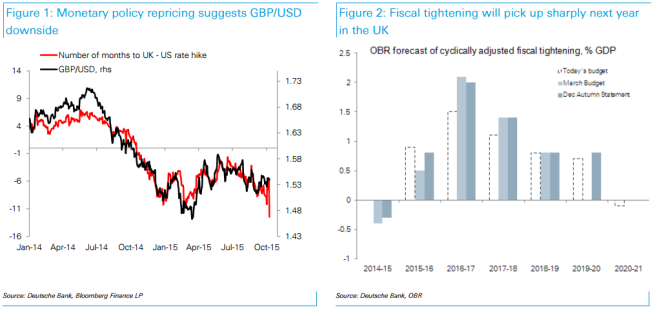

1) Short-end rates now suggest GBP downside.

“GBP/USD has closely tracked the relative timing of UK vs. US rate hikes and this mechanically implies the cross below 1.50,” DB notes.

2) The window for policy exit may now close.

“Absent a remarkable volte-face, the MPC has now relinquished its optionality for a hike in H1 next year. The problem is that it may be too late after that for exit. Fiscal tightening is set to pick-up sharply in 2016, with the UK undergoing the largest fiscal consolidation of any G10 economy, at 1.5% of GDP,” DB adds.

3) Absent rate support, sterling much more vulnerable to twin deficits and expensive valuation.

“A robust recovery and high interest rates relative to European peers has helped to finance a very large deterioration in the UK’s current account deficit since 2011…If rate support were to fade, slowing foreign capital inflows could see a sharp correction in sterling,” DB argues.

“In sum, with a near-term hiking cycle off the table, the rationale for being long sterling has disappeared. Further analysis will need to be undertaken for the future outlook.

In the meantime we recommend turning short GBP/USD, which should also benefit from our bearish EUR/USD call,” DB advises.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.