The US dollar raged across the board following the excellent NFP report. Can it continue rising?

The team at BNP Paribas weighs in:

Here is their view, courtesy of eFXnews:

BNP Paribas positioning analysis signals USD positioning was very light heading into last Friday’s jobs release, implying plenty of scope for positions to build in anticipation of a strong finish to the year for the dollar.

“However, we would be wary of extending near-term targets for EURUSD too aggressively beyond current levels,” BNPP warns.

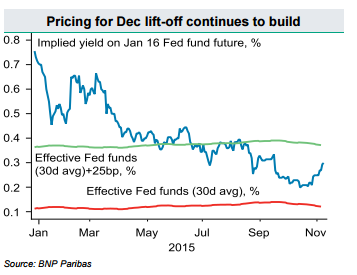

“The Fed remains very FX sensitive and too rapid dollar appreciation would risk the FOMC warning that currency moves could limit scope for tightening in 2016, even if they do deliver a first rate hike on December 16.

Similarly, while the ECB seems committed to delivering further easing in December, continued weakening of EURUSD would raise the possibility that they deliver a less significant package of new measures, disappointing elevated expectations,” BNPP argues.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.