After the overwhelmingly strong NFP report, EUR/USD has dropped quite a bit. There may be lots more to come.

Here is the view from Goldman Sachs:

Here is their view, courtesy of eFXnews:

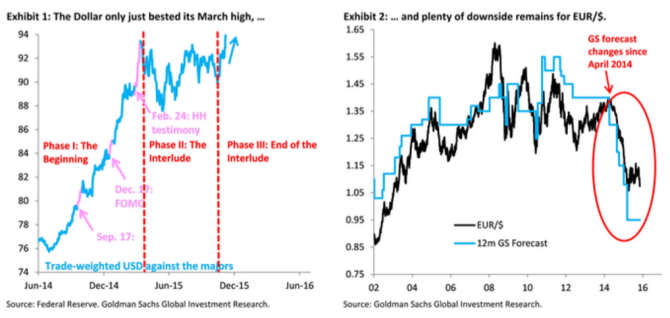

In a note to clients today, Goldman Sachs follows-up on its high-conviction call that the period of indecision for the Dollar from the March FOMC to recent ECB and Fed meetings, has ended and that the path of least resistance for EUR/USD is resuming its underlying bearish trend from here.

“The Interlude,” as we call this period, was characterized by a Fed that shifted dovish after sharp Dollar gains in March and a subsequent Bund sell-off that, in our eyes, undercut the credibility of ECB QE.

This week’s employment data have made December lift-off all but certain, validating the expectation of our US economics team, but markets – still suffering the after-effects of “The Interlude” – are hesitant to embrace Dollar longs again. After all, on a trade-weighted basis versus the majors, the greenback only on Friday surpassed its March peak,” GS argues.

In particular, GS pushes back on two popular arguments for why the Dollar is capped near current levels:

“(i) that lift-off and subsequent tightening by the Fed is not all that Dollar positive, on the grounds that some of this is priced; and (ii) that Fed lift-off makes ECB easing in December less likely or ambitious. We disagree with both and see them mostly as a reflection of damage incurred during “The Interlude”,” GS adds.

“The ECB again shifted in a dovish direction in October, followed by a hawkish move from the Fed the same month. In short, both central banks look to be pursuing domestic objectives, which is of course what monetary policy should look like with freely floating exchange rates…We think the big challenge for the ECB is to get underlying inflation up towards its inflation target, which will necessitate both additional stimulus and, equally important, more stable Bund yields,” GS argues.

“Given the magnitude of this challenge and the reluctance of the market to re-embrace the Euro down theme, we still see plenty of scope for EUR/$ down. To parity and beyond,” GS projects.

GS sees EUR/USD trading at 1.05 ahead of the ECB December meeting, and at 0.95 in 12 month.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.