The Canadian dollar was certainly not a winner in 2015. A lot has to do with oil. What lies ahead for the loonie?

The team at SocGen weighs in:

Here is their view, courtesy of eFXnews:

The outlook for the Canadian dollar (CAD) into mid-2016 is for further depreciation against the US dollar, but likely outperformance against other G10 commodity currencies, projects SocGen.

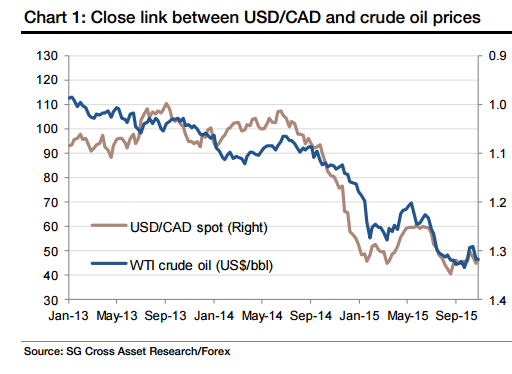

“The Canadian dollar has been heavily affected by movements in crude oil prices in recent years. There has been an average correlation of -0.55 on USD/CAD spot versus WTI front-month prices year-to-date, using daily two-month rolling correlation.

Our commodity strategists expect crude oil prices to stabilise at current levels and trade sideways until mid-2016, so CAD will not be getting a lift from oil in the next few months,” SocGen argues.

“The Bank of Canada will also lag the Fed in raising rates. The Liberal victory in the Canadian federal elections should result in a small fiscal boost to growth. The Liberals promised increased infrastructure spending and a more redistributive tax system, and that should boost growth marginally over the next two years,” SocGen adds.

“This implies that USD/CAD should rise further in coming months, to 1.35 by mid-2016 in our view. CAD however should outperform the likes of AUD and NZD on the back of the Fed lift-off in H1 2016,” SocGen projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.