According to the press release of 22 September, the Central Bank of the Republic of Turkey’s (CBRT) Monetary Policy Committee decided to keep the overnight funding rate at 10.75% and the borrowing rate at 7.25. The CBRT’s MPC also noted that “…Loan growth continues at reasonable levels in response to the tight monetary policy stance… …favorable developments in the terms of trade and the moderate course of consumer loans contribute to the improvement in the current account balance… … External demand remained weak… …while domestic demand contributed to growth… …The composition of growth is expected to shift gradually towards net exports in upcoming periods with the support of rising demand from the European Union economies…”

As far as the continuing outlook, the statement noted that, “…Considering the impact of the uncertainty in domestic and global markets on inflation expectations and taking into account the volatility in energy and food prices, the Committee decided to maintain the tight liquidity stance as long as deemed necessary… … Inflation expectations, pricing behavior and other factors that affect inflation will be monitored closely and the cautious monetary policy stance will be maintained…” The point of the matter is that the CBRT, under Governor Basci, is determined to keep its inflation containment policy utilizing high policy rates.

Guest post by Mike Scrive of Accendo Markets

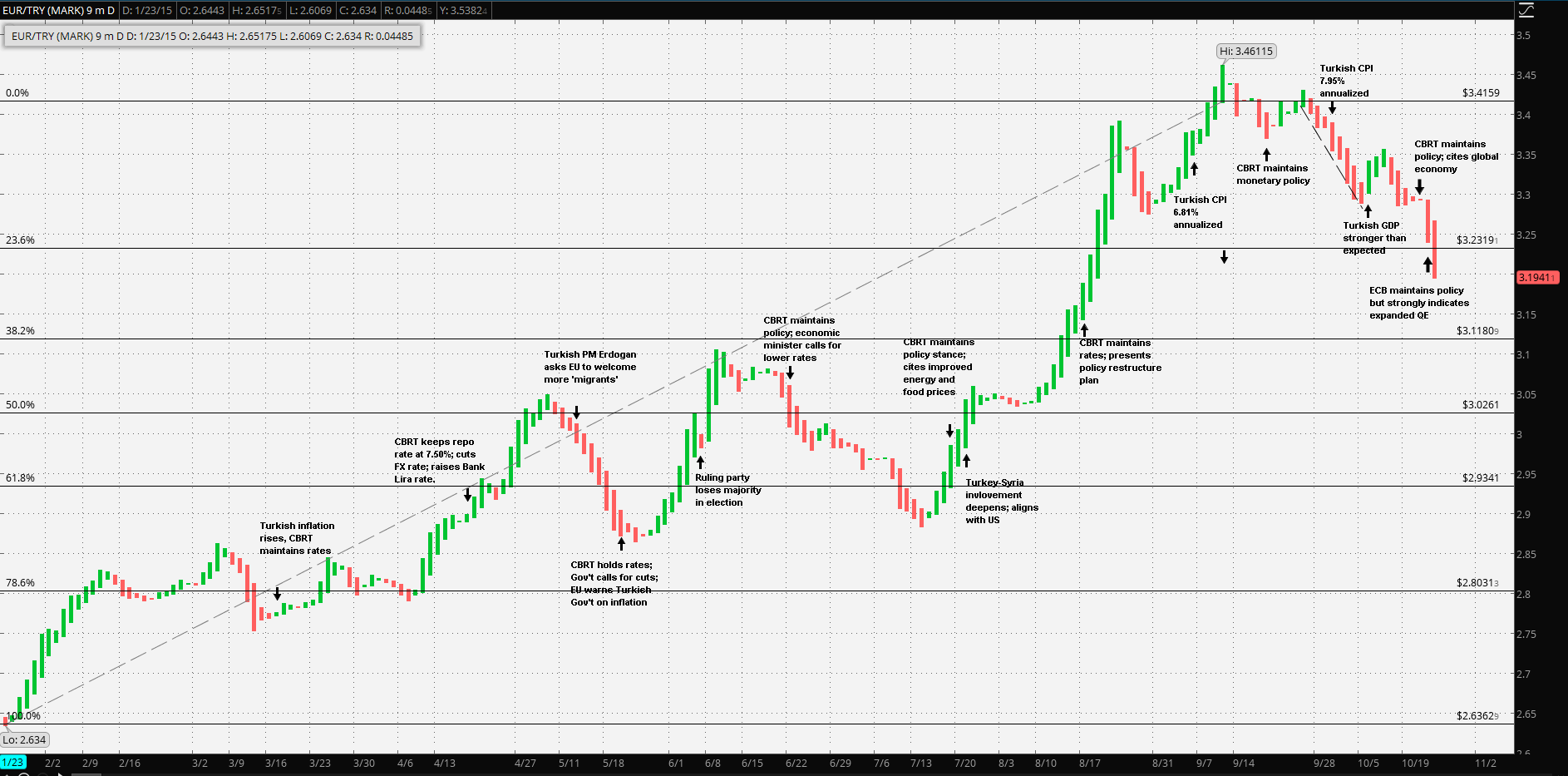

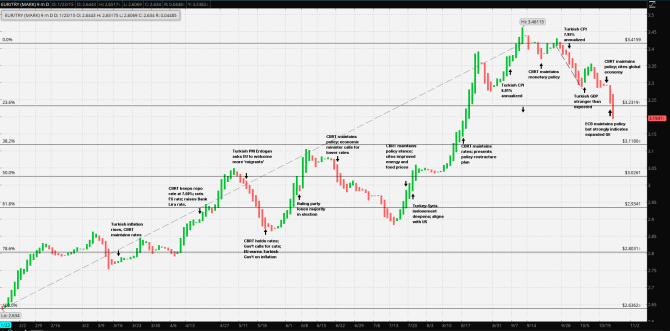

The last rate decrease, 25 basis points on overnight borrowing to 7.25% and 50 basis points on the lending rate to 10.75% were made at the 25 February meeting of this year. Governor Basci’s job has been anything but easy. Turkish President Tayyip Erdogan struggled to keep his ruling party’s majority coalition in power while the economy slowed. Government officials called for the CBRT to reduce rates further, but Mr. Basci stuck to his policy. The Erdogan government lost the parliamentary majority in the 7 June elections. As if to add insult to injury, President Erdogan could hardly blame the CBRT as recent data demonstrated that the economy grew by 3.8% in Q2, better than 10% over consensus. The Erdogan government will now certainly refrain from trying to manage CBRT policy without a majority and growing economy and new elections scheduled for 1 November. The entire point being that Governor Basci’s policy is vindicated, which strengthens the CBRT’s independent policy decision making.

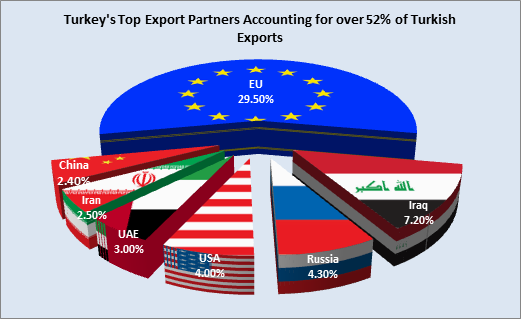

When the EU is counted as one entity, just over 52% over Turkey’s export destination is distributed among its top 8 trade partners. As such, the EU is Turkey’s top export partner, accounting for more than 29% of Turkey’s total exports. Turkey has been a candidate country for EU membership since 1999. Although not yet an EU member state, Turkey and the EU have a bilateral trade relationships through a long standing and recently upgraded Customs Union Agreement.

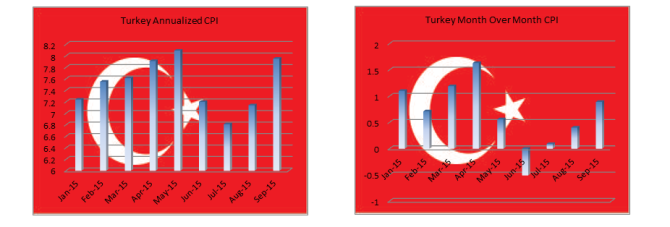

ECB President Draghi may only wish for some of the inflation Governor Basci is trying to contain. The ECB has maintained a negative overnight deposit facility rate of -0.20% and a marginal lending facility of 0.30%. However, recent data indicates that even after a year of negative to marginal policy rates, plus a €60 billion asset purchase target, consumer prices remain stubbornly low. At the 3 September post meeting press conference, Mr. Draghi noted that, “…Real GDP in the euro area rose by 0.3% in the second quarter of 2015, which was somewhat lower than previously expected… …risks to the euro area growth outlook remain on the downside, reflecting in particular, the heightened uncertainties related to the external environment… …increase in annual inflation rates is currently expected to materialise somewhat more slowly than anticipated thus far...” In answer to a reporter’s question on inflation Mr. Draghi added that, “…We may see negative numbers of inflation in the coming months… …The Governing Council tends to think that these are transitory effects…”

In answer to a question on QE President Draghi stated that: “…the Governing Council wanted to emphasise in the discussion we had today its willingness to act, its readiness to act, and its capacity to act, its ability to act. There aren’t special limits to the possibilities that the ECB has in gearing up monetary policy…”

At the 22 October meeting, President Draghi strongly implied that the ECB would likely expand its QE in December “…when the new Eurosystem staff macroeconomic projections will be available. The Governing Council is willing and able to act by using all the instruments available within its mandate if warranted in order to maintain an appropriate degree of monetary accommodation…”

The CBRT seems just as intent to stay the course and by doing so the Lira should strengthen vs the Euro. In fact, in the days following the September CBRT announcement, the Lira gained a little more than 4% on the Euro and just over 5% from the 9 month high; after the ECB statement it gained about 1.5% from the previous day. The CBRT policy stance was reiterated after the 21 October meeting: “…Considering the impact of the uncertainty in domestic and global markets on inflation expectations and taking into account the volatility in energy and food prices, the Committee decided to maintain the tight liquidity stance as long as deemed necessary…”

The potential of a weaker Euro plus the indefinite policy stance of the CBRT should continue to narrow the gap between the Lira and Euro, putting Turkey on a more equal footing with many of its EU neighbors.

Mike Scrive

“CFDs, spread betting and FX can result in losses exceeding your initial deposit. They are not suitable for everyone, so please ensure you understand the risks. Seek independent financial advice if necessary. Nothing in this article should be considered a personal recommendation. It does not account for your personal circumstances or appetite for risk.”