The ECB is dead serious to fight deflation with Draghi using his top verbal skills and showcasing the best of his weaponry to hit the euro hard.

This may be only the beginning. The team at Goldman Sachs lays out scenarios for EUR/USD reaching down to 1.05:

Here is their view, courtesy of eFXnews:

“ECB President Draghi put additional monetary stimulus, above and beyond the measures announced in January, on the map for the December 3 meeting. In particular, he raised the possibility of stepping up the existing QE program and / or cutting the deposit rate further.

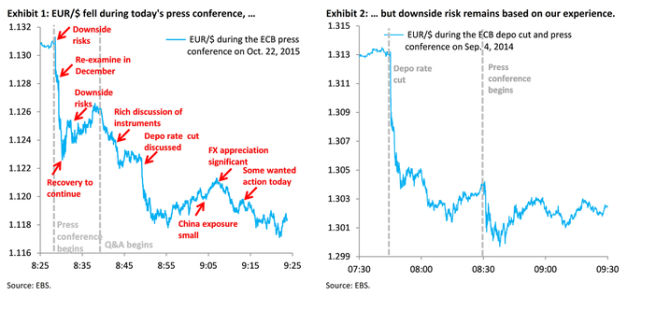

EUR/$ moved substantially lower during the press conference, but we argue in this FX Views that potential downside is still substantial. As we noted in our FX Views earlier this week, we think a 10 bps (surprise) deposit cut is worth two big figures downside in EUR/$. We base that assessment on empirical work we did last year and the September 2014 surprise deposit cut, when EUR/$ fell around two big figures.

At the very least, following today’s press conference, a December deposit cut is now possible, meaning that EUR/$ – which went into the meeting at around 1.13 – should reprice to 1.11. Of course, there is a good chance that December will instead bring an actual augmentation of the QE program, such that downside in EUR/$ might be larger. The kind of scenarios our European economics team envisage imply downside of at least 5-6 big figures from here, i.e. should see us return to near the 1.05 low that EUR/$ made in March.”

Robin Brooks, George Cole and Michael Cahill – Goldman Sachs

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.