The team at HSBC continues challenging the consensus and explains why the US dollar could be on the cusp of a weakening trend.

We have certainly seen some weakening today because of the poor retail sales report. Could this get much worse for the greenback. Here is their view:

Here is their view, courtesy of eFXnews:

“We believe the consensus is making two big errors that are already leading it astray in its view of where currencies are heading.

A) The consensus continues to “now-cast” rather than “forecast”, obsessed mistakenly with “when” the US Federal Reserve will begin to raise interest rates. The more pertinent questions are “how high” will rates go, and “how long” will it take to get them there? This is the real debate that the FX market will have in future months and that will determine currency fortunes well into 2016.

B) The consensus is ignoring the lessons of post-crisis central banking. Central banks that have begun to tighten policy have been forced to stop early and, in many instances, ease policy afresh. The confidence among the consensus that the Fed can break this mould seems at odds with the US data and the global outlook.

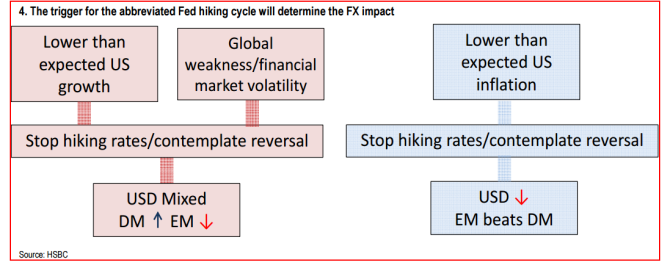

The currency implications of this shift in Fed expectations will depend on the catalyst. If the abbreviated cycle is prompted by a benign US inflation backdrop rather than a realisation that it was a mistake to tighten in the first place, we believe the USD will see wholesale weakness. Monetary policy divergence, which has favoured the USD for more than a year, could go into sharp reverse. It would be a very different world for the USD, and a far more challenging one for USD bulls.

We believe there is excessive optimism on the USD, especially against G10 currencies. Having seen the end of the USD bull run against developed market currencies, we could now be on the cusp of a weakening USD trend. The upcoming US tightening cycle could be unconventionally brief, confounding USD bulls relying on the US Federal Reserve to deliver a more aggressive series of rate hikes than is currently priced in.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.