EUR/USD experienced a roller coaster week, eventually closing lower despite not so dovish words from Draghi.

This could continue, says the team at Deutsche Bank, citing the specific source of weakness:

Here is their view, courtesy of eFXnews:

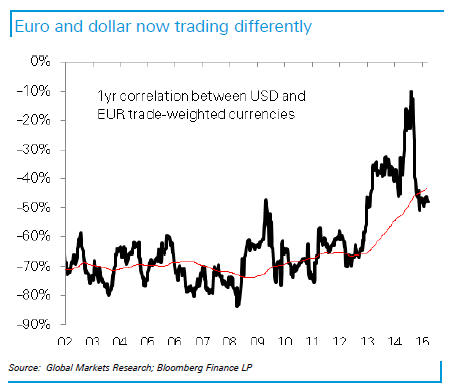

“EUR/USD has strengthened over the summer despite the large dollar rally. This reveals a significant shift in the underlying drivers away from the broad dollar trend. The negative correlation between the world’s two major currencies dropped to the lowest on record this year and has structurally turned.

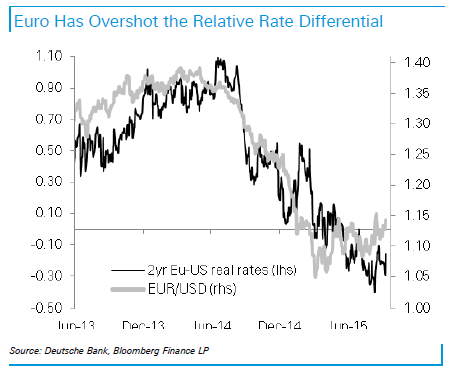

Indeed, running through a list of more than 30 financial markets drivers shows that European equity markets and rates are now the dominant drivers of EUR/USD in a similar idiosyncratic dynamic to the yen. Draghi protection remains in place The euro has already overshot rate differentials with the US, with both nominal and real spreads suggesting fair value below 1.10.

Euro funded position unwinds and risk-aversion may be the underlying drivers, but we believe this is likely to have run its course. First, the ECB has indicated that it will not tolerate an additional tightening in financial conditions. Further risk-aversion will be followed by ECB easing putting renewed pressure on the euro. The EONIA curve still reaches an inflection point next year suggesting the market is not pricing an aggressive extension of the PSPP program. Second, even if aggregate dollar longs on the IMM are extended, both euro and yen shorts now stand at the lowest in more than a year. There is plenty of scope to re-build positions irrespective of the broad dollar trend.

We remain bearish and therefore like selling EUR/USD targeting the year’s 1.05 lows by end-15.”

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.