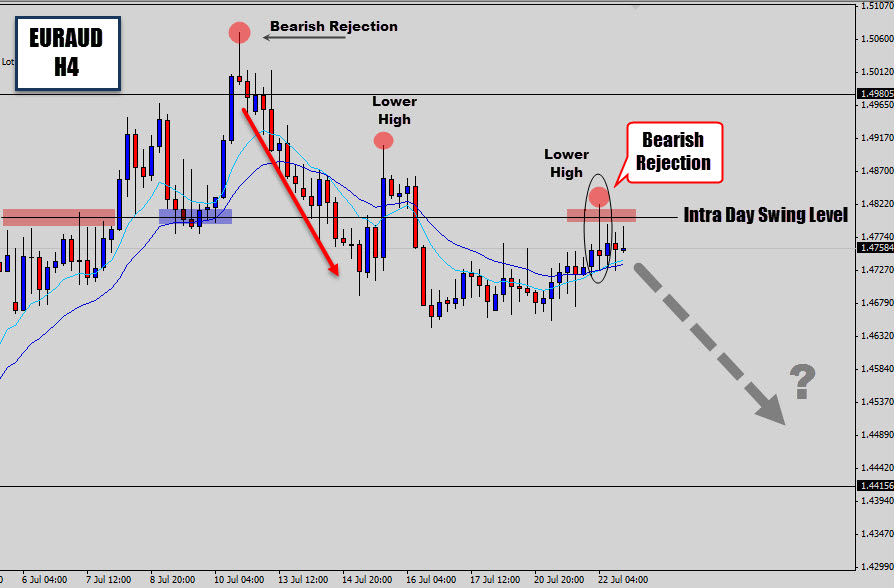

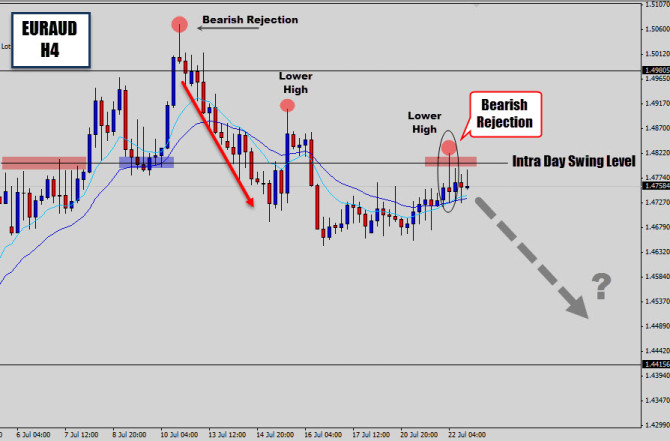

The EURAUD market has been dropping lower highs on the 4 hour chart as it progressively weakness, swinging down into lower prices.

The daily chart also is dropping below support levels and look quite bear heavy. The daily chart is testing resistance now, which corresponds to the intra day swing level I have marked on the chart above.

The 4 hour chart shows the better downtrend swinging structure, and we’ve just got a 4 hour bearish rejection candle sell signal form here – terminating the up move, and communicating higher prices are not favored here.

The rejection candle has been open for a couple of hours, and is offering a retracement entry setup. If this price action reversal signal follows through with a bearish move, we may even see a sell signal on the daily chart.

Lets see how it goes.

Dominant Trend Takes Over

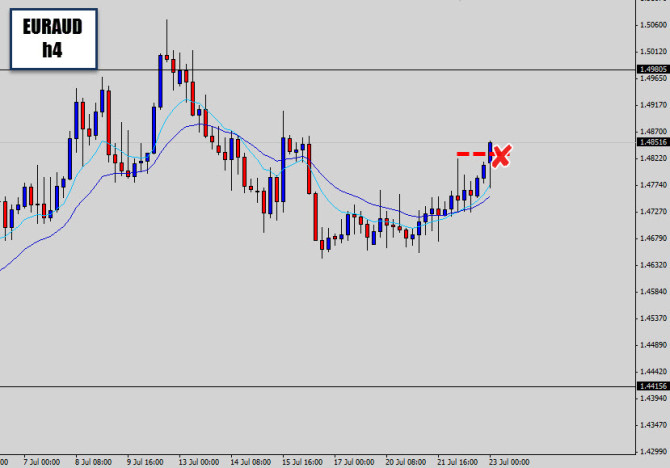

So the trade didn’t end up working out. There was no bearish response from the setup and the dominant daily uptrend on the EURAUD daily chart ended up taking over.

This is why it’s important to use excellent money management all the time. I am not ashamed to post a losing trade, as it is part of Forex trading.

If this 4 hour signal kicked off a bearish move, it would have most likely produced large reward.

Now just waiting for the next signal ????