The value of EUR/USD does not solely depend on Greece. The big players remain the central banks, with their monetary policies and their reserves.

The team at Nomura assesses the situation and what it means for the euro:

Here is their view, courtesy of eFXnews:

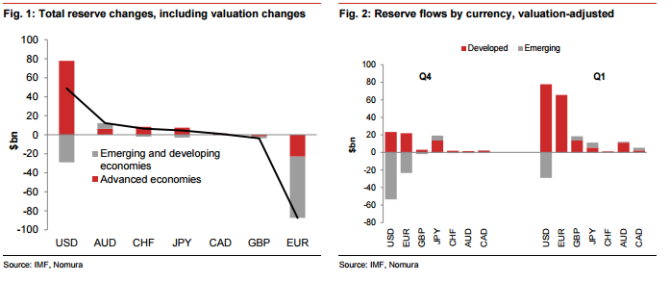

The Euro share of global central bank reserves fell significantly again in Q1 2015 according to IMF COFER data published on Tuesday, notes Nomura.

“The Euro share of global reserves dropped 1.4 percentage points to 20.7%. This was even more striking in emerging markets, where the EUR allocation fell 1.7pp to 19.6% from 21.4%, driven by EUR valuation adjustments and lack of any rebalancing flows. The allocation in advanced economies fell by 1.1pp, despite large Swiss and Danish intervention, which likely bought mostly EUR, to maintain their respective floor and peg,” Nomura clarifies.

“Normally “portfolio rebalancing” would create positive flows (EUR buying) to offset valuation effects when the price of the Euro declines – this happened during the early part of the Euro crisis, for example, although it has not been the case in recent quarters,” Nomura argues.

“As such, it seems that global reserve managers continue to have “portfolio rebalancing” on hold in the face of monetary policy divergence and negative interest rates on a large portion of their EUR holdings,” Nomura adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.