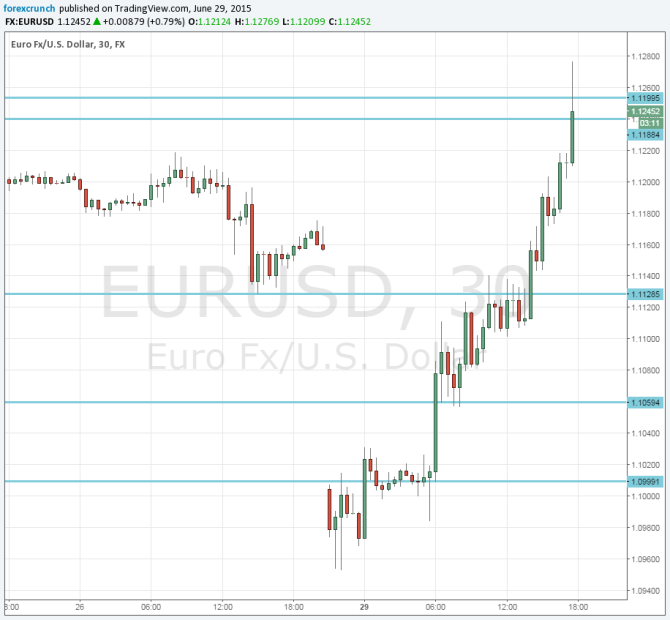

EUR/USD is trading at 1.1250 already reaching 1.1276, over 100 pips from the close on Friday. Since Friday, the Greek crisis went into overdrive, with the breakup of talks, the Greferendum announcement, the rejection of the bailout, the ECB freeze of ELA and the capital controls. A lot of alarming events.

So how come the Sunday gap was not only filled but surpassed? Here are 5 reasons for the comeback:

- EUR is now a funding currency: The ECB not only has an almost zero lending rate (0.05%) but it also has a negative deposit rate of -0.20%, which basically “punishes” banks for parking money with it. The cheap funding means that money moves outside the euro-zone and this has been going on for already more than a year. However, in times of trouble, some of this money is repatriated to Germany and France, thus supporting the euro.

- Other safe havens: The traditional safe haven currencies are the Japanese yen and the Swiss franc. Indeed, the news from Greece gave a big boost to the yen. With money flowing to Japan and back to Europe, the dollar’s safe haven status is a weaker one.

- SNB intervention: The floor of 1.20 under EUR/CHF has been shockingly removed back in January, but the SNB continues intervening to weaken the franc. Specifically today, Thomas Jordan explicitly said that his institution was active in the markets. So, the Swiss were on the euro bid.

- “Door is still open”: European officials including Moscovici and Dijesselbloem have said that the door to negotiation with Greece is still open. This softened the sense of crisis. Also Merkel and Hollande talked about negotiations, but they referred to after the Greferendum, which they see as a vote on the euro.

- Effect on US rates: Monetary policy divergence has driven EUR/USD lower – the ECB is printing euros while the Fed is about to raise rates. But if Greece leaves the euro-zone and there are negative effects on other countries, will the Fed be in a rush to raise the rates so fast? The dovish FOMC, led by Yellen, will likely adopt a “better safe than sorry” approach if Greek jitters, accompanied by Chinese ones pose a risk to the US economy. As with occasional reaction in stocks, the “bad news is good news” effect happens: lower chance of Fed tightening is a key element.

What do you think? Any other reasons for the 300+ pips up from the lows?

Greek crisis – all the updates in one place

And here is how it looks on the charts: EUR/USD is trading well above Friday’s levels: