Commodity currencies often run in tandem with each other and sometimes in a different manner to the major currencies.

What’s going on in AUD and CAD? The team at CIBC weighs in:

Here is their view, courtesy of eFXnews:

The following are CIBC’s weekly outlook for the USD, CAD, and AUD.

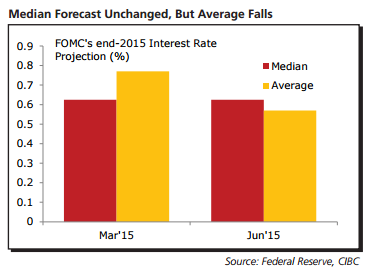

Not So Dotty On the US$. The Fed sounded more confi dent on growth prospects for the remainder of this year, and continued to signal that if the economy grows as expected, interest rates will rise before 2015 is out.Yet the US$ weakened on the news. Why? Largely because the “dot plot” of interest rate projections suggested an even slower hiking path than it did back in March. While the median forecast for the end of 2015 was unchanged at 0.625%, a straight average reveals somewhat more of a consensus than before.

However, should the economy improve as we expect, September still appears to be the most likely time for lift-off, which would help the US$ recover back towards early-year highs.

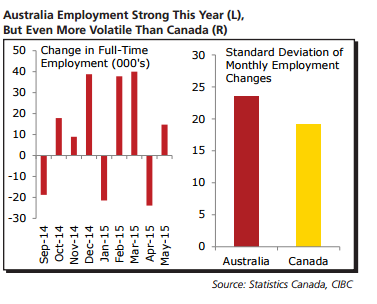

CAD to Hop Higher Above AUD. Australia’s recent employment report showed solid job gains and a falling unemployment rate. However, we wouldn’t put too much weight behind one employment release, given that monthly changes in this report move up and down more than a kicking kangaroo.

Interestingly, the report is even more volatile than the one in Canada – which we often have a hard time believing. As a result, we still see more of a chance that the RBA cuts rates below the current historically low yield of 2.00% than the BoC slashing rates below 0.75%.

With markets forced to guard against another rate cut, the aussie should lose ground to the loonie in the near term.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.