So, we had the Fed and the Greek crisis is still going on. EUR/USD did move up to the higher end of the range but still respects the double top.

So what’s next for euro/dollar and all its moving parts? The team at Credit Suisse lays it out:

Here is their view, courtesy of eFXnews:

In an attempt to explain the EUR choppy price action in recent weeks, Credit Suisse parses through the ongoing Greek default risk outlining how this has impacted the single currency’s risk-reward from a trading perspective.

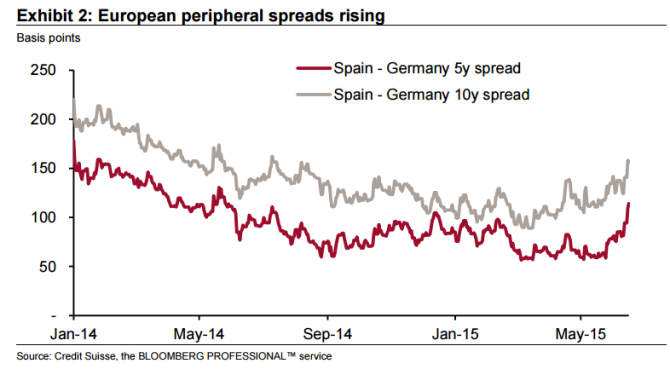

“As Exhibit 2 shows, the rising threat of an actual Greek default to either the IMF, the Eurosystem or both has led to a sharp jump in periphery vs core spreads in the euro area towards one-year highs in the past week. Interestingly, this has not led to a meltdown or even especially high realised volatility in EUR currency space. EURUSD has not moved far from where it stood two weeks ago, while 1-week EURUSD realised volatility is around 12.5%, close to its 2015 average and well below highs around 19% seen in March. This is quite different to more obvious sensitivity to such spread changes in previous Greek crisis periods such as in 2012,” CS notes.

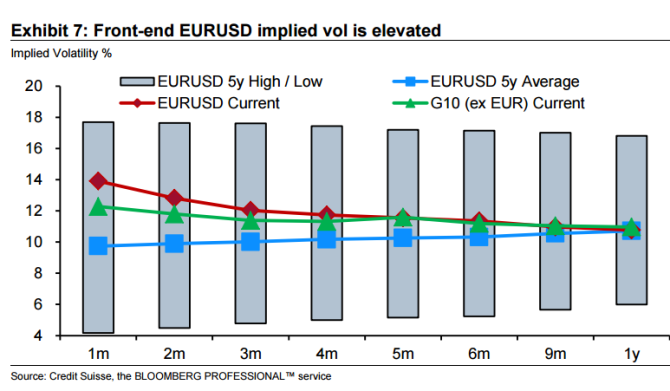

“An observation of the shape of implied volatility for EURUSD gives more of a sense of crisis than the behavior of spot itself might suggest. As Exhibit 7 shows, the EURUSD implied volatility curve is currently inverted, a feature that is indicative of near-term risk aversion. Still, the fact that longer-term levels are in line with historical averages suggests the market is not expecting a persistent source of risk to materialize. Greek risk is priced as a storm in a teacup rather than a source of a transformational and sustained volatility rise,” CS adds.

What does this mean in terms of how to trade the EUR?

“At least for the next month, the market seems clearly in two minds as to whether to treat it as a pro or anti-risk currency. Does it rally if Greek risk is resolved given that European risky assets would do well, or does it perversely go lower as volatility and VaR levels fall and the near-term risk of short covering squeezes dissipates? As long as these questions remain hard to answer, immediate risk-reward for EUR positioning is unappealing,” CS advises.

“From a longer-term perspective, we continue to feel that EURUSD will eventually move lower in line with a stalling out of positive data momentum in the euro area just as the US data cycle has improved,” CS adds.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.