When I first began my Forex journey 6 years ago, I was completely in awe of the number of different strategies and indicators that were out there. It can be seriously overwhelming for a new trader. In the first 3 years I tried just about every indicator and strategy known to man. Nothing was working, but I was determined to become a profitable Forex trader.

By this point, I had so many indicators filling my chart that I could barely see the current price. One day I realized that I was making a fatal flaw – I wasn’t trading the market anymore, I was trading indicators. You see, I was so focused on what the indicators were doing that I completely forgot about what price was doing, also called ‘price action’. So I cleared EVERYTHING from my chart and suddenly it hit me. I had my “ah ha” moment.

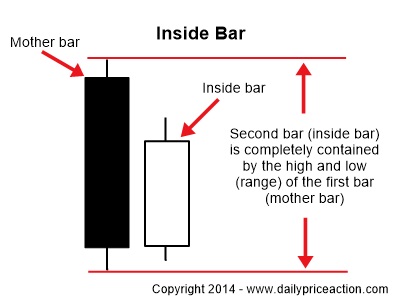

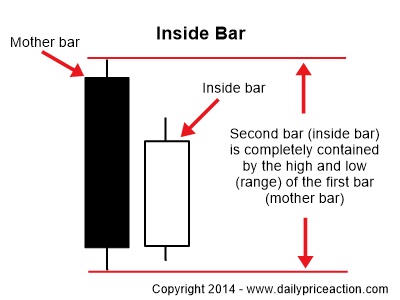

Now that I could actually see what price action was doing and it was pretty obvious. I set out defining support and resistance levels and began reading every price action book and article I could get my hands on. Soon I had developed price action patterns that, at the right market levels, were producing consistent results. I was relieved…I could now set my focus on developing a trading plan that I could have confidence in.

I later found two moving averages which worked really well with the price action patterns I had developed. Having come from an “indicator-addict” background, the moving averages fit right in ???? So I now had my moving averages, price action patterns, confluent levels, etc. all working in tandem. This was 3 years ago, so halfway through my Forex trading career up until now. I’m still using the same strategies today as a full-time trader and business owner. I can’t imagine going back to all those indicators, when all I need is my two moving averages and simple price action patterns ????