The US dollar has been left, right and center in recent days, but there are two sides to a currency pair. The euro did receive some positive economic indicators, but Greece looms.

The team at Deutsche Bank explains why EUR/USD is still a good short:

Here is their view, courtesy of eFXnews:

In a note to clients, Deutsche Bank updates its outlook on EUR/USD where DB is structurally bearish arguing that even as the pair has seen one of the largest drops in history over the last twelve months, the trend has more to go, but this time led by dollar strength, rather than euro weakness.

In particular, DB advises clients to stay short EUR/USD, and to add to their shorts at current levels. The following are some of the main reasons that DB outlined behind this argument, along with its targets for that short EUR/USD trade.

Pain after gain, but it should be over. “EUR/USD has squeezed higher over May, but the technicals now look more supportive, suggesting the move is behind us,” DB projects.

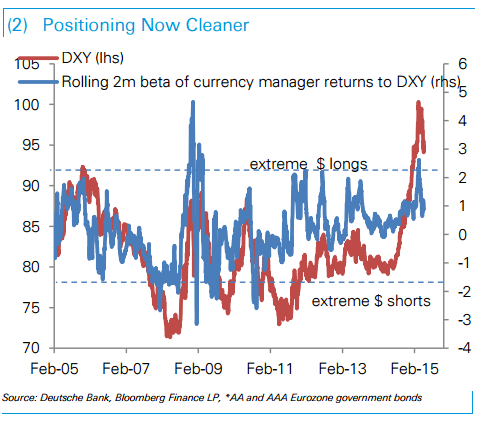

Cleaner positioning. “Equally, positioning metrics suggest that dollar longs have being pared back. A regression of currency manager index returns against the DXY now points to flat positioning, while the IMM shows a greater than 50% paring back in dollar longs,” DB notes.

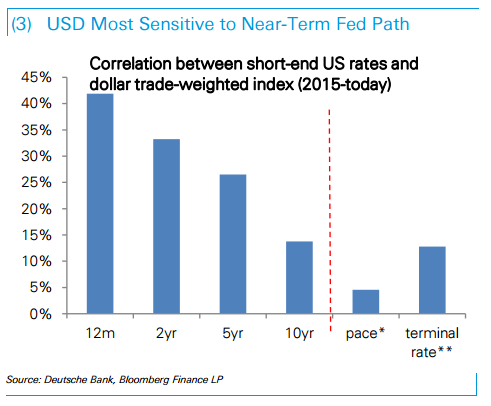

All about the Fed. “History has been all about the ECB, but the dominant driver of FX is now likely to be the Fed. On that front, monetary policy could come back in focus sooner than many expect,” DB argues.

Euro still a good short. “While market focus is very likely to shift to the other side of the Atlantic, EUR/USD is still a good vehicle to express dollar longs. To start with, the euro is a consistent underperformer around Fed turning points,” DB advises.

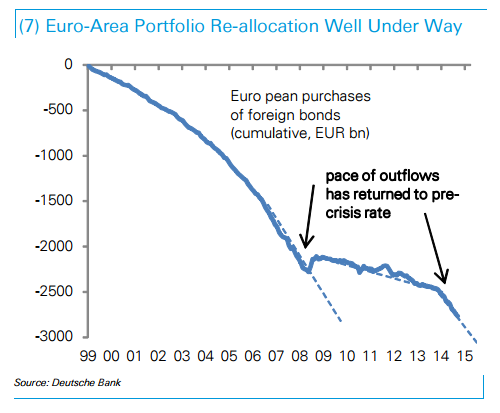

Negative Euro flows. “Beyond that, the European flow picture remains very negative. The recent VaR shock in bund yields is likely to further discourage, rather than encourage fixed income inflows,” DB adds.

Target: “We continue to target a move down to 1.00 by the end of the year,” DB projects.

Conclusion. “The ingredients remain in place for a strong dollar trend this year. Given that focus is likely to shift to Fed tightening, rather than ECB easing, we like rotating positions away from the trade-weighted euro towards longs in the trade-weighted dollar. Still, EUR/USD should continue to be a primary casualty of broad dollar strength,” DB concludes.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.