EUR/USD turned sharply down from resistance at 1.1450 and found support only at the very round level of 1.10.

The team at Morgan Stanley explains why a top is in place and how it could continue falling, with targets for Q2, Q3 and Q4:

Here is their view, courtesy of eFXnews:

In its weekly FX note to clients today, Morgan Stanley argues that the EUR/USD has already a top in place as the USD has turned around, completing its downward correction within a secular bull trend. The following are some of the main reasons that MS outlines behind this argument along with its latest EUR/USD forecasts.

ECB keeps transmission channels open:

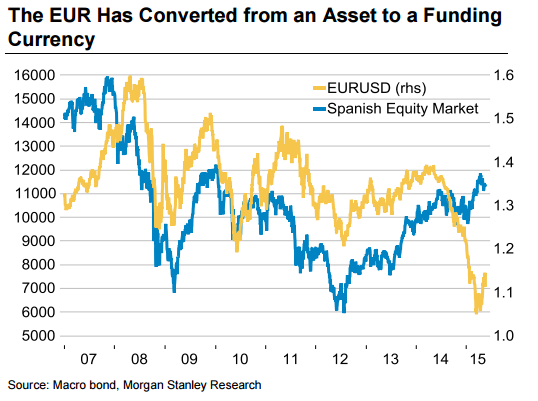

“Risk appetite remains the key variable for judging the EUR. The EUR’s funding status suggests repatriation related inflows will occur when investors reduce risk exposure, while rallying equity markets would push the EUR lower. The ECB is primarily relying on two transmission channels for its nonstandard monetary policy measures, we believe: i) higher portfolio valuations potentially unleashing demand via wealth effects, and ii) a lower EUR shifting relative competitiveness in favour of the eurozone,” MS argues.

The ECB, the EUR and risk:

“High bond market volatility can block these channels by weakening the outlook for risky assets, while simultaneously pushing the EUR higher. At this stage the EMU economic recovery seems too fragile for the ECB to allow monetary transmission to weaken. Hence, we would expect the bank to verbally intervene whenever it feels it has to unlock these channels. This weekend’s ECB Forum provides a platform to communicate with markets,” MS adds.

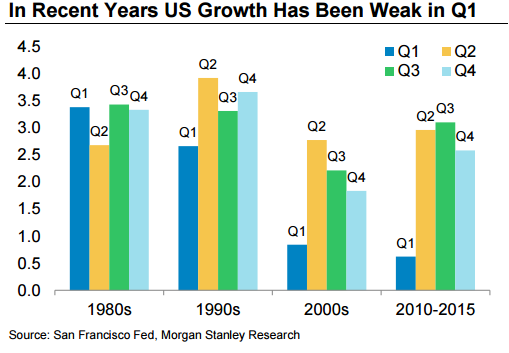

Positioning for US rebound:

“Otherwise, it will be potential US data strength that steers the outlook for the USD…Our analysis indicates both the USD and GBP are in a strong position. EUR weakness should be steered by the ECB and its attempt to keep monetary transmission intact,” MS projects.

EUR/USD forecasts:

MS maintains its EUR/USD forecasts at 1.04 by Q2-end, 1.03 by Q3-end, and 0.98 by year-end.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.