The Swiss franc was mixed today following the release of an updated economic forecast from Switzerland’s government. The State Secretariat for Economic Affairs released an updated economic forecast for 2020 and 2021. The updated forecast predicts that gross domestic product adjusted for sports events will fall by 3.8% this year, which is better than the July forecast of a 6.2% drop. The Consumer Price Index is expected to fall by 0.7%, whereas the previous … “Swiss Franc Mixed After Positive Revision of Economic Forecasts”

Author: admin_mm

US Dollar Flat As Investors Weigh Fiscal Stimulus Talks, Wait for Inflation Data

The US dollar is kick off the trading week relatively flat, hovering at its lowest level in three weeks. With not much economic data to work with, investors are weighing fiscal stimulus in Washington and the 2020 presidential election in a couple of weeks. Will traders adopt a wait-and-see approach to the greenback for the remainder of October? On Sunday, President Donald Trump urged Congress to approve a stripped-down version of the fiscal stimulus and relief package. The White … “US Dollar Flat As Investors Weigh Fiscal Stimulus Talks, Wait for Inflation Data”

Japanese Yen Gains During Monday’s Quiet Trading

The Japanese yen gained, rising against all other most-traded currencies, during Monday’s quiet trading. Today’s calendar is light in terms of macroeconomic releases, and trading is expected to be quieter than usual due to holidays in the United States and Canada. As for today’s economic reports in Japan itself, they were mixed. The Bank of Japan reported that the Producer Price Index fell by 0.8% in September, year-on-year, after declining by 0.6% in August. … “Japanese Yen Gains During Monday’s Quiet Trading”

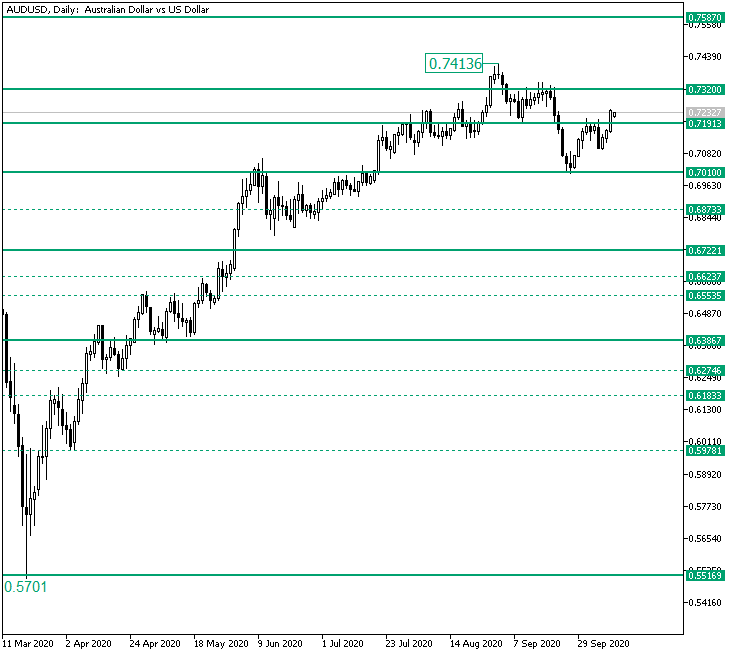

Bulls Set for 0.7320 on AUD/USD?

The Australian versus the United States dollar currency pair seems to be determined to reach for 0.7320. Long-term perspective The rise that took place from the 0.5701 low extended all the way to the 0.7413 high. From there, the price slipped under the 0.7320 level, which had just been pierced. The resulting drop reached the next support area, 0.7191. From 0.7191, the bulls attempted a recovery, but their efforts were limited … “Bulls Set for 0.7320 on AUD/USD?”

Canadian Dollar Rallies Against US Peer on Upbeat Jobs Data

The Canadian dollar today rallied against its US peer fueled by the positive Canadian jobs report and the upbeat investor sentiment. The USD/CAD fell for the third straight session as the commodity-linked loonie rallied higher capitalising on the greenback’s weakness over the same period. The USD/CAD currency pair today fell from an opening high of … “Canadian Dollar Rallies Against US Peer on Upbeat Jobs Data”

Mexican Peso Strengthens As Inflation Slows, Economic Data Improves

The Mexican peso is strengthening against some of its peers to close out the trading week, buoyed by slowing inflation and improving macroeconomic data. The peso has been one of the top-performing Latin American currencies in recent months, despite the coronavirus pandemic failing to subside and the public health crisis affecting the regionâs second-largest economy. Last month, the consumer price index (CPI) rose 0.23%, down from the 0.39% increase in August. At an annualized rate, … “Mexican Peso Strengthens As Inflation Slows, Economic Data Improves”

Sterling Pound Rallies Despite UK GDP Missing Estimates

The pound today edged higher against the US dollar despite the UK’s latest GDP print missing expectations boosted by the positive investor sentiment. The GBP/USD currency pair was also lifted by news that the Rishi Sunak would announce a new jobs support programme later today fueling Britain’s economic recovery. The GBP/USD currency pair today rallied … “Sterling Pound Rallies Despite UK GDP Missing Estimates”

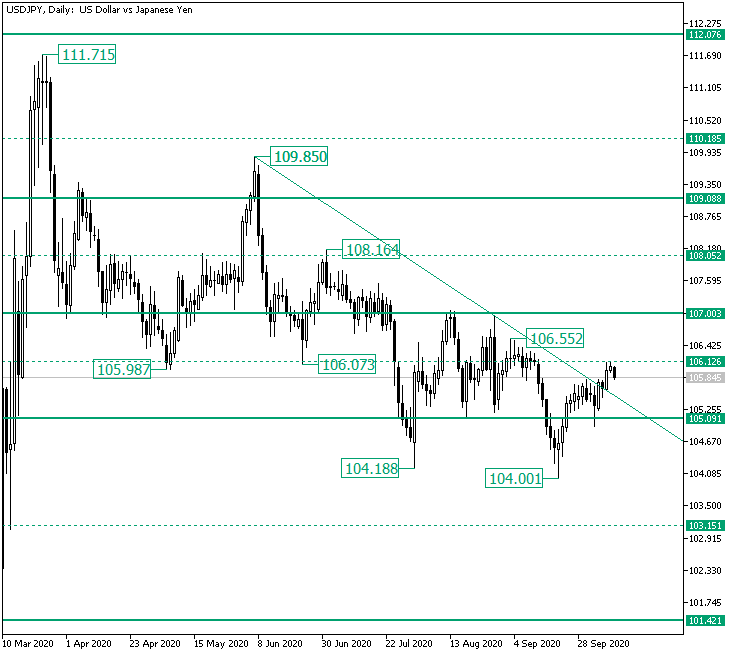

Bearish Resistance at 106.12 on USD/JPY?

The United States dollar versus the Japanese yen currency pair may have trouble passing the 106.12 level. Is this just a bullish pause? Long-term perspective The drop from the 111.71 peak delivered two flats. The first one is limited by 109.00 as resistance — with the amendment of the 109.85 fake breakout — and 107.00 as support — joined by two false piercings that were bounded by the 106.12 intermediary level. The second is confined within … “Bearish Resistance at 106.12 on USD/JPY?”

Euro Falls Against Strong Dollar Despite Revived Stimulus Talks

The euro today fell against the US dollar driven by the risk-off market mood, which saw riskier assets selloff in favour of safe-haven assets such as the greenback. The EUR/USD currency pair’s decline occurred at a major resistance level as sellers stepped in driving the pair to its daily lows buoyed by the weak German data. The EUR/USD currency pair today rallied to a high of 1.1781 in the early Frankfurt session before falling to a low of 1.1733 in the early American … “Euro Falls Against Strong Dollar Despite Revived Stimulus Talks”

US Dollar Seeks Direction As Initial Jobless Claims Fall to Fresh Pandemic Low

The US dollar is searching for direction on Thursday after the number of Americans filing for first-time unemployment benefits fell to a fresh pandemic low. But the latest numbers indicate that jobless claims are sliding at a sluggish pace as hiring slows down. With Washington in a stalemate over stimulus funding, it might be hard to forecast the greenbackâs performance in the short-term amid political uncertainty. According to the Department of Labor, initial jobless claims came … “US Dollar Seeks Direction As Initial Jobless Claims Fall to Fresh Pandemic Low”