The euro today crashed against the US dollar following the release of mixed data from the euro area as market sentiment remained decisively bearish. The EUR/USD currency pair fell to new 1-week lows in the American session following the release of upbeat US Q3 GDP data. The EUR/USD currency pair today fell from a high of 1.1123 in the early European session to a low of 1.1081 … “Euro Crashes on Mixed Eurozone Reports and Upbeat US Prints”

Author: admin_mm

US Dollar Spikes on Higher Q3 GDP Reading

The US dollar enjoyed a spike against several currency rivals at the end of the trading week, driven primarily by a higher final reading of the gross domestic product in the third quarter. The buck was further lifted on a decline in the cost of manufacturing goods consumed at home and exported to foreign markets. … “US Dollar Spikes on Higher Q3 GDP Reading”

Pound Rallies on Upbeat UK GDP Report, Falls Ahead of Brexit Vote

The Sterling pound today inched higher against the US dollar boosted by the release of the upbeat UK Q3 GDP data in the early London session. The GBP/USD currency pair barely reacted to the appointment of a new Bank of England Governor, which was expected by most analysts and investors. The GBP/USD currency pair today rose from an opening low of 1.3007 to a high of 1.3048 in … “Pound Rallies on Upbeat UK GDP Report, Falls Ahead of Brexit Vote”

Australian Dollar Extends Rally Caused by Stellar Employment Data

The Australian dollar continued to rise today following yesterday’s rally. The rally was a result of a very positive employment report that showed a bigger-than-expected employment growth and an unexpected drop of the unemployment rate. Released yesterday by the Australian Bureau of Statistics, the report showed that employment rose by 39,900 in November, exceeding the consensus forecast of an increase of 14,500 by a wide margin. Both full-time and part-time employment registered an increase, though the bulk of the increase consisted of part-time jobs. … “Australian Dollar Extends Rally Caused by Stellar Employment Data”

NZ Dollar Retreats After Rallying on Better-than-Expected GDP

The New Zealand dollar retreated today following yesterday’s gains. The rally was a result of a faster-than-expected growth demonstrated by New Zealand’s economy in the previous quarter. Statistics New Zealand reported yesterday that gross domestic product grew by 0.7% in the September quarter from the previous three months, beating the median forecast of a 0.5% increase. Year-on-year, the economy expanded by 2.7%. The main contributor to the growth of services industries, which make up two-thirds of the economy, … “NZ Dollar Retreats After Rallying on Better-than-Expected GDP”

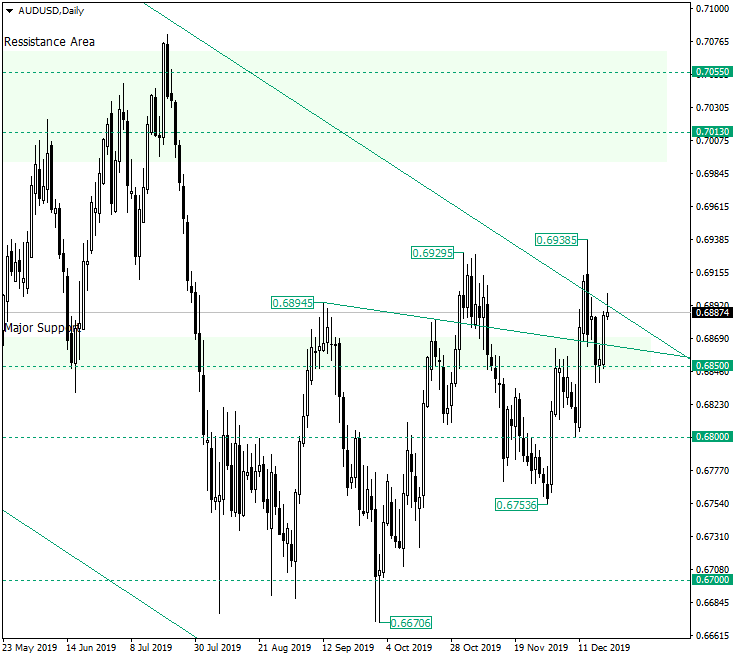

AUD/USD in a Very Interesting Spot Above 0.6850

The Australian dollar versus the US dollar currency pair is at the resistance area of the daily descending channel. But why does it seems that something is not in place? Long-term perspective After bottoming at the 0.6700 psychological level, the price entered in an ascending movement that extended until 0.6938. By doing so, it pierced the resistance trendline of the descending channel. However, the break was rendered as a false one after the price went … “AUD/USD in a Very Interesting Spot Above 0.6850”

Japanese Yen Gains After Inflation Data, BoJ Monetary Policy Decision

The Japanese yen gained against other most-traded currencies after today’s release of inflation data and yesterday’s monetary policy decision of Japan’s central bank. The gains were limited, though, as markets are feeling the holiday mood and trading is slowing. The Statistics Bureau of Japan reported that the national core (excluding food) Consumer Price Index rose by 0.5% in November, year-on-year, accelerating from the previous month’s 0.4% rate of growth and matching … “Japanese Yen Gains After Inflation Data, BoJ Monetary Policy Decision”

Canadian Dollar Flat on Lower Weekly Earnings, Drop in Wholesale Sales

The Canadian dollar is trading relatively flat against most currency rivals on Thursday as traders digest the newest data that offer a mixed portrait of the national economy. The modest gain in crude oil prices could not lift the loonie higher toward the end of the trading week. According to Statistics Canada, average weekly earnings for non-farm payroll employees rose 3.3% year-on-year in October to $1,042. This is down from the 3.7% increase … “Canadian Dollar Flat on Lower Weekly Earnings, Drop in Wholesale Sales”

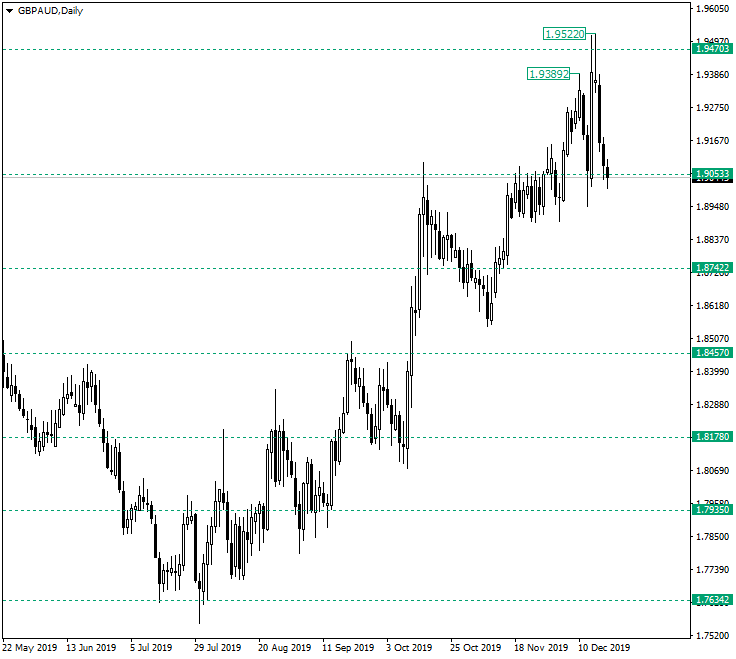

GBP/AUD Struggles with the Bears at 1.9053

The Great Britain pound versus the Australian dollar currency pair seems to have already been conquered by the bears. Are the bulls left with any chances? Long-term perspective The appreciation that started at 1.7634 may have already ended at 1.9470, as the price was repelled in a very strong manner. Even less beneficial for the bulls, the depreciation that came after 1.9470 was confirmed as resistance washed away most of the gains that were … “GBP/AUD Struggles with the Bears at 1.9053”

Canadian Dollar Gets Boost from CPI & Crude Oil Prices

The Canadian dollar climbed against its most-traded peers, emerging as the strongest major currency today. The combination of robust inflation and resilient prices for crude oil was the reason for the currency’s amazing performance. Statistics Canada reported that the seasonally adjusted Consumer Price Index rose by 2.2% in November, year-on-year, accelerating from October’s 1.9% rate of growth. The reading matched expectations. Excluding gasoline, the CPI rose by 2.3%. On a seasonally adjusted monthly basis, … “Canadian Dollar Gets Boost from CPI & Crude Oil Prices”