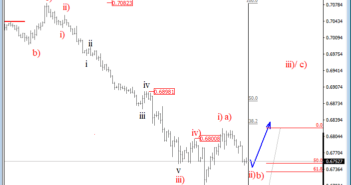

Bigger, bearish, impulsive structure (meaning with five legs) on Aussie can be completed, as we see a sharp recovery from the 0.668 regions, which can already be part of a three-wave reversal. The current three-wave move can take price towards 0.6898 minimum target region, however once minor wave b)/ii) correction fully develops. AUDUSD, 4h NZDUSD … “Are Bulls Back in Business on AUDUSD and NZDUSD? – Elliott wave Analysis”

Author: admin_mm

USD/JPY has more room to fall on trade wars

USD/JPY has been extending its slump amid intensifying trade wars. Tensions between the US and China and the US consumer are set to dominate. Mid-August’s technical daily chart is pointing to further falls. When the going gets tough, the tough get going. As the US-Sino trade war turned into a currency war, the Japanese currency … “USD/JPY has more room to fall on trade wars”

EUR/USD enjoyed the trade wars and that may come to an end

EUR/USD has recovered thanks to the dollar’s weakness. Updated euro-zone GDP, the US consumer, and trade are eyed. Mid-August’s daily chart is pointing to fresh falls for the pair. “When two are fighting, the third wins” – goes the saying. The euro has benefited from the intensifying US-Sino trade spat. China has devalued its yuan … “EUR/USD enjoyed the trade wars and that may come to an end”

GBP/USD has yet to see the bottom as Boris’s Brexit weighs heavily

GBP/USD has managed to halt its decline but failed to recover amid the US-Sino trade war. Concerns about a hard Brexit and three top-tier British figures stand out this week. Mid-August’s daily chart is pointing to further losses. Brexiteers build on a robust trade agreement with America after the UK leaves the EU – and … “GBP/USD has yet to see the bottom as Boris’s Brexit weighs heavily”

Euro Rallies Amid US Dollar Sell-Off Driven by Rising Trade Tensions

The euro today rallied higher against the US dollar as investors fled the greenback and US equity markets in favour of riskier assets such as the single currency. The EUR/USD currency pair today rallied above the crucial 1.1200 level as investors piled into the currency given the US dollar’s crash in the face of rising … “Euro Rallies Amid US Dollar Sell-Off Driven by Rising Trade Tensions”

Chinese Yuan Crashes Below Crucial USD Level Amid Trump Tariffs

The Chinese yuan fell below a key level against the US dollar to kick off the trading week after President Donald Trump announced new tariffs on billions in Chinese goods. While some experts posit that it might not have any economic significance, the trend could escalate tensions between the worldâs two largest economies over trade and the exchange rate — two topics important to Washington. Last week, the White … “Chinese Yuan Crashes Below Crucial USD Level Amid Trump Tariffs”

AUD/USD may extend losses even if the RBA leaves rates unchanged

The Reserve Bank of Australia is set to leave rates unchanged in its August meeting. The RBA weighs global risks against recent upbeat figures in Australia. AUD/USD has more chances to drop than to rise in response to the event. When the US Federal Reserve cuts interest rates – others follow. However, in the Reserve … “AUD/USD may extend losses even if the RBA leaves rates unchanged”

Surprise index points to a downside surprise in the ISM Non-Manufacturing PMI

The US ISM Non-Manufacturing PMI is a critical leading indicator. FXStreet’s Surprise Index points to a downside surprise. The US dollar may lose ground on the news. Will the Federal Reserve cut interest rates in September? That is the main question currency traders are asking and the answer – as the Fed puts it – depends on the data. … “Surprise index points to a downside surprise in the ISM Non-Manufacturing PMI”

AUD/USD Declines for Twelfth Session on Range of Factors

The Australian dollar declined today, falling for the twelfth consecutive session against its US counterpart. There were plenty of reasons for the decline: unfavorable domestic macroeconomic data, poor economic reports in China, escalation of US-China trade tensions. The Australian Industry Group Australian Performance of Services Index dropped from 52.2 in June to 49.3 in July. That was the biggest drop in a year. Furthermore, being below the neutral 50.0 level, the indicator suggested … “AUD/USD Declines for Twelfth Session on Range of Factors”

US Dollar Mixed After Fed Cut, Escalation of Tensions Between US & China

It was expected that the monetary policy decision of the Federal Reserve would be the major event this week. While the Fed had indeed a big impact on markets, ultimately it was overshadowed by new developments in the US-China trade conflict. The resulting risk aversion allowed the US dollar to rise against riskier commodity currencies but drove the greenback down versus safer currencies. The Fed cut interest rates by 25 basis … “US Dollar Mixed After Fed Cut, Escalation of Tensions Between US & China”