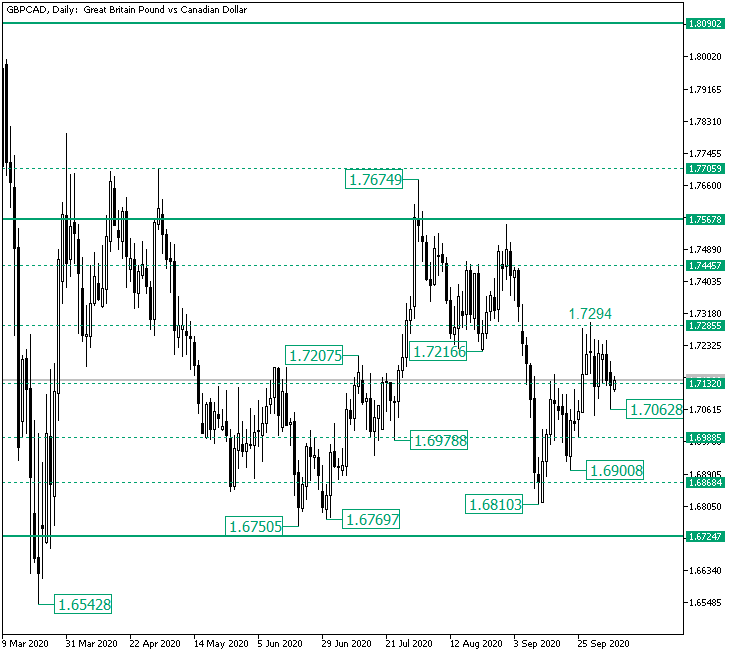

The Great Britain pound versus the Canadian dollar currency pair seems to have found support at 1.7132. Are the bulls ready for a new march? Long-term perspective After the retracement that came about with the definition on the chart of the 1.6542 low, the market entered into an extended range trading phase, limited by 1.7567 as resistance and 1.6724 as support. The last upward pointing movement came into being after the price noted the double bottom highlighted … “1.7285 Next Target for GBP/CAD?”

Author: admin_mm

Sterling Pound Rallies As UK Govt Prepares for No-Deal Brexit

The Sterling pound today rallied against the dollar on positive investor sentiment before falling on Brexit jitters after comments from the Irish government. The GBP/USD currency pair later rallied even after the UK said that it was actively preparing for a no-deal Brexit scenario as the October 15 deadline approaches. The GBP/USD currency pair today … “Sterling Pound Rallies As UK Govt Prepares for No-Deal Brexit”

Japanese Yen Weakens As BoJ Warns of âVery Highâ Uncertainty Amid COVID-19 Pandemic

The Japanese yen is under pressure in the middle of the trading week as the central bank warned that economic uncertainty remains âvery highâ because of the coronavirus pandemic. But the yen could find support on macroeconomic data suggesting the contraction in the worldâs third-largest economy might have subsided. Could the traditional safe-haven asset continue its strong 2020 in the final quarter? Speaking in a video message to an annual meeting of securities firms, Bank of Japan (BoJ) … “Japanese Yen Weakens As BoJ Warns of âVery Highâ Uncertainty Amid COVID-19 Pandemic”

Euro Strong After Market Sentiment Recovers

The euro was strong today, rising against all other most-traded currencies, with the exception of the Australian dollar. The possible reason for the rally was the market sentiment, which was recovering after confusing tweets from US President Donald Trump. Macroeconomic reports released in the eurozone today were mixed. Markets entered a risk-off mode after the news broke out that Trump halts negotiations with Democrats about a big stimulus … “Euro Strong After Market Sentiment Recovers”

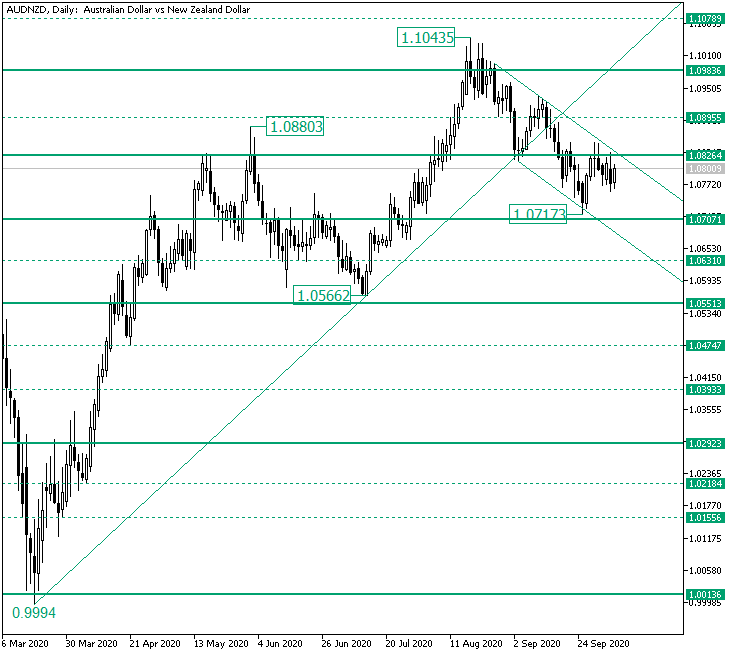

AUD/NZD Prepared to Break 1.0826?

The Australian versus the New Zealand dollar currency pair seems to be willing to go towards the north. Do the bulls have the power to do so? Long-term perspective The appreciation from the 0.9994 low extended, after a correction phase bounded by the 1.0880 high and 1.0566 low, respectively, to 1.1043. Noteworthy is that the 1.1043 high comes outside of the resistance area that the firm level of 1.0983 represents. And because — after such a departure — the bulls … “AUD/NZD Prepared to Break 1.0826?”

Canadian Dollar Falls Against US Peer on Trump Stimulus Tweets

The Canadian dollar today gave up most of its gains against the US dollar as the latter rallied boosted by the risk-off market sentiment as stimulus hopes dissipated. The USD/CAD currency pair rallied higher during the American session as President Donald Trump dashed all hopes of a US stimulus deal ahead of the November 3 elections. The USD/CAD currency pair today rallied from a low of 1.3242 during the Asian market to a high of 1.3316 during … “Canadian Dollar Falls Against US Peer on Trump Stimulus Tweets”

USD/TRY Retests 7.8 As Inflation Surges, Geopolitical Tensions Escalate

The Turkish liraâs recovery since hitting all-time lows against the US dollar and the euro has stalled. The currency is once again testing 7.8 per dollar amid ballooning inflation and rising geopolitical tensions in the region. Global financial markets have been apprehensive about Ankaraâs potential involvement in the Armenia-Azerbaijan conflict, with President Recep Tayyip Erdogan supporting Baku in the renewed battle. According to the Turkish Statistical Institute, the consumer price … “USD/TRY Retests 7.8 As Inflation Surges, Geopolitical Tensions Escalate”

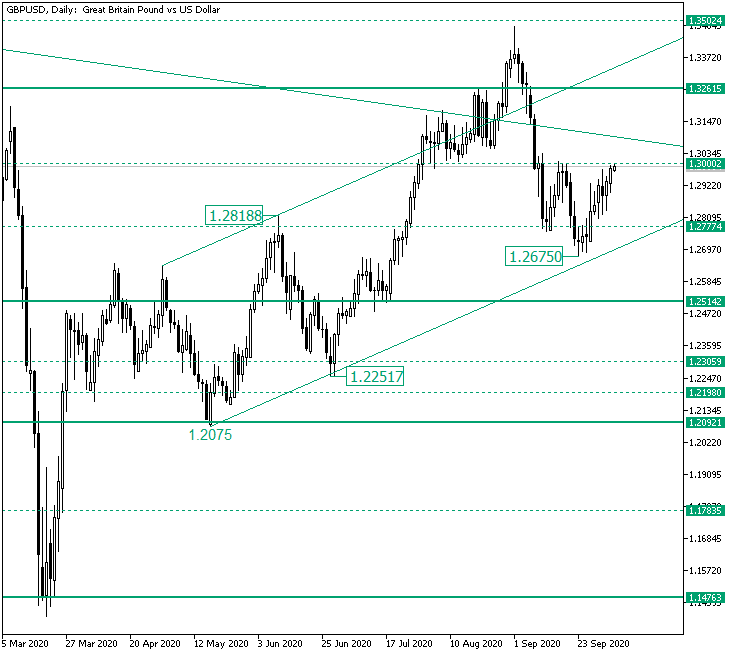

GBP/USD Back to the 1.3000 Level

The Great Britain pound versus the US dollar currency pair sits just under the 1.3000 psychological level. Where to from here? Long-term perspective The trend that started at the 1.2092 support, after the 1.2075 low was printed, managed to appreciate a hair away from 1.3502. However, as the retracement from 1.3502 failed to find support at 1.3261, the price fell beneath the triple resistance defined by 1.3261, the descending trendline, and the upper line of the ascending … “GBP/USD Back to the 1.3000 Level”

Chinese Yuan Flat After Having Best Quarter in a Decade

The Chinese yuan is trading flat against the US dollar, but it has topped 8.0 against the euro to kick off the trading week. The yuan is coming off its best quarter in more than a decade as analysts warn think the yuan could become the next safe-haven currency amid volatility. Can the yuan test 6.6 in the final quarter of 2020? The broader financial market has been surprised by the yuan’s appreciation … “Chinese Yuan Flat After Having Best Quarter in a Decade”

AUD/USD Under 0.7191. Have the Bulls Met Resistance?

The Australian versus the US dollar currency pair slipped under the 0.7193 level and looks like it has difficulties in regaining it. Could this be a bearish sign? Long-term perspective The appreciation that started from the 0.5701 low advanced until the 0.7413 high. However, after falling beneath 0.7320, the price began a descending movement, as the bullish attempt to validate 0.7191 as support failed. The bullish missed effort left the bears with … “AUD/USD Under 0.7191. Have the Bulls Met Resistance?”