The euro fell to a two-year low against some of its major currency rivals on Thursday after the European Central Bank (ECB) left interest rates unchanged but prepared investors for additional easing in the fall. President Mario Draghi essentially maintained a sour outlook on the eurozone economy, suggesting that the ECB needs to maintain and deliver a âhighly accommodativeâ policy even when Christine Lagarde becomes the new head. At its July policy meeting, … “Euro Weakens As ECB Signals September Rate Cut, More QE”

Author: admin_mm

South African Rand Gains After Inflation Beats Expectations

The South African rand gained today after nation’s inflation beat expectations. South Africa’s annual inflation was at 4.5% in June, the same as in May and above the market consensus of 4.4%. Core inflation was at 4.3%, up from 4.1% in May, which was the lowest rate in more than a year. Monthly inflation was at 0.4%, up from 0.3% in the previous month and matching forecasts. USD/ZAR edged down from 13.9115 to 13.8908 … “South African Rand Gains After Inflation Beats Expectations”

NZ Dollar Gains After Trade Surplus Widens Unexpectedly

The New Zealand dollar rose today after the nation’s trade surplus widened unexpectedly last month. Statistics New Zealand reported that the trade balance logged a surplus of NZ$365 million in June, up from NZ$175 million in May (revised, NZ$264 million before the revision). That was a total surprise to market participants who were expecting a drop to NZ$100 million. The quarterly trade balance posted a deficit of NZ$773 million. NZD/USD … “NZ Dollar Gains After Trade Surplus Widens Unexpectedly”

Euro Trades Sideways at 2-Month Lows on Weak German PMI Data

The euro today traded sideways against the US dollar with a slight bearish bias following the release of disappointing German and eurozone PMI data by Markit Economics. The EUR/USD currency pair today remained under pressure as investors wait for tomorrow’s European Central Bank monetary policy decision, which many expect to be dovish. The EUR/USD currency … “Euro Trades Sideways at 2-Month Lows on Weak German PMI Data”

Australian Dollar Falls After PMI Releases

The Australian dollar fell against other most-traded counterparts today after the Purchasing Managers’ Indices showed that both manufacturing and service sectors continued to expand but with a slower pace. The Commonwealth Bank Flash Manufacturing PMI fell to 51.4 in July from 52.0 in June. The Commonwealth Bank Flash Services Business Activity Index dropped to 51.9 in July from 52.6 in June. CBA Senior Economist Belinda Allen commented on the results: … “Australian Dollar Falls After PMI Releases”

Chinese Yuan Edges Higher As Beijing Slaps Anti-Dumping Duties on Steel Imports

The Chinese yuan is edging higher midweek after the federal government announced that it would be slapping anti-dumping duties on steel imports from major regional trading partners. This might be part of the nationâs strategy of âarduous effortsâ to match this yearâs industrial output growth target, particularly as protectionism and trade wars apply pressure on exports and affect the world’s second-largest economy. Recently, the Ministry of Commerce confirmed that … “Chinese Yuan Edges Higher As Beijing Slaps Anti-Dumping Duties on Steel Imports”

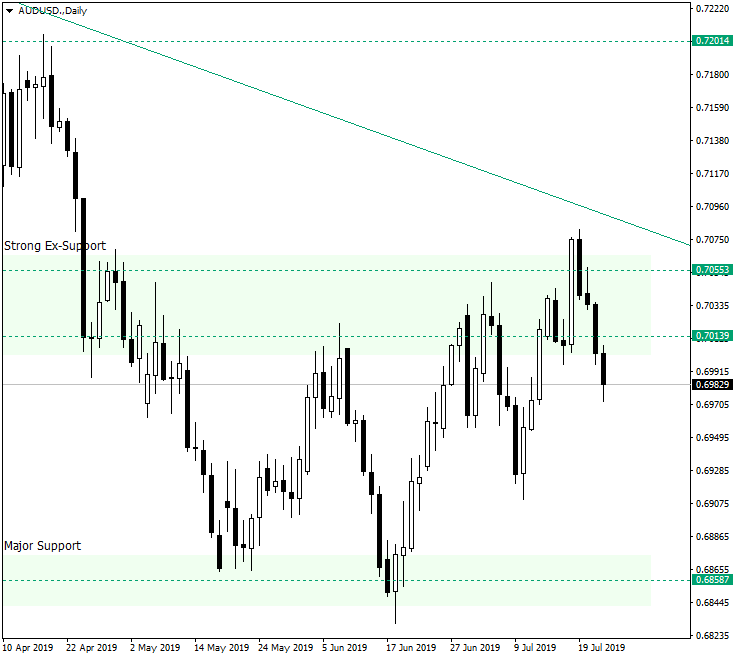

AUD/USD Not Ready Yet for 0.7200

The Australian dollar versus the US dollar currency pair has not seized the opportunity to go for 0.7200, probably because of a resistance that is to hard to breach. Long-term perspective Since the middle of June 2018 the pair is in a descending move and the latest developments etched on the chart what can be considered an inverted head and shoulders. This, added to the longevity of the trend, has all the reasons to point towards the possibility of a trend change. But it … “AUD/USD Not Ready Yet for 0.7200”

Euro Crashes to 7-Week Lows As the US Dollar Surges Higher

The euro today fell against the US dollar for the third consecutive session as investors trimmed their expectations of a massive rate cut by the Fed boosting the greenback. The EUR/USD currency pair was also affected by market expectations of the announcement of further monetary easing policies by the ECB later this week. The EUR/USD currency pair today fell from an opening high of 1.1208 to a low of 1.1147 in the American session and was trading near these lows at the time … “Euro Crashes to 7-Week Lows As the US Dollar Surges Higher”

Pound Recovers As Boris Johnson Becomes PM, Capped by Bearish Data

The British pound is rallying on Tuesday after it was confirmed that former London Mayor Boris Johnson would become Britainâs new prime minister. In addition to a higher pound, European markets appeared to cheer on the pro-Brexit politician as leading indexes recorded 1% gains. But that did not prevent disappointing data from capping the currencyâs … “Pound Recovers As Boris Johnson Becomes PM, Capped by Bearish Data”

Japanese Yen Weakens on BOJ Uncertainty Over Monetary Easing

The Japanese yen is softening to kick off the trading week after investors learned very little from a much-anticipated speech by the head of the Bank of Japan (BOJ). On Monday, central bank governor Haruhiko Kuroda disappointed investors when he said any monetary policy moves will depend on the performance of the national economy and global markets. Still, most economists believe the next move for the BOJ will be additional easing. Speaking at a Michel … “Japanese Yen Weakens on BOJ Uncertainty Over Monetary Easing”