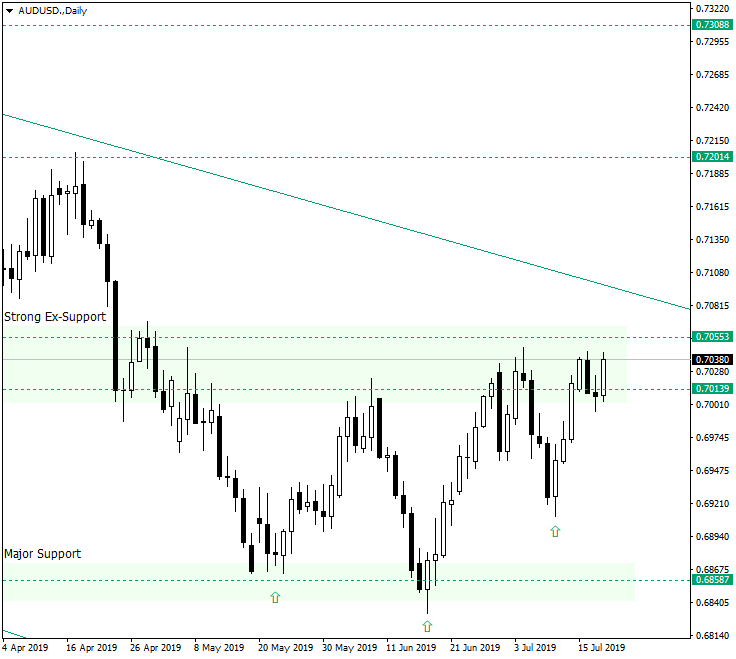

The Australian dollar versus the US dollar currency pair is at an important resistance area, but the bulls are very determined. The clues for which path the price will take lie in a few details. Long-term perspective The price is in a downwards movement since the mid of 2018, but is also limited by the support of 0.6858 and the resistance area of 0.7055 and 0.7013. Between this support and resistance zones the waves typical for a consolidative phase took shape. … “AUD/USD Facing an Important Test Before Continuing Towards 0.7200”

Author: admin_mm

Euro Drops on Fears of Further Monetary Easing From the ECB

The euro today fell from its daily highs against the US dollar as markets reacted to news that the European Central Bank was considering a different approach to meet its inflation target. The EUR/USD currency pair later recovered given that the greenback was also under significant selling pressure as markets continue to price in a Fed rate cut on July 31. The EUR/USD currency pair today fell from a … “Euro Drops on Fears of Further Monetary Easing From the ECB”

Weak Employment Data Doesn’t Prevent Rally of Australian Dollar

Australian employment data came out today much weaker than was expected. Yet that did not prevent the Australian dollar from rising against the majority of its most-traded peers. The Australian Bureau of Statistics reported that the seasonally adjusted number of employed people increased by a meager 500 in June from the previous month, whereas analysts had predicted a solid increase of 9,100. The May increase got a positive revision from … “Weak Employment Data Doesn’t Prevent Rally of Australian Dollar”

Yen Mixed Despite Shrinking Trade Deficit

The Japanese yen was mixed today, rising against some majors, such as the US dollar and the euro, but falling against commodity currencies as well as the Great Britain pound. The decline of global stocks and domestic macroeconomic data were supportive of the currency, but that was not enough to bolster the yen sufficiently. Japan’s trade balance deficit shrank to ¥0.01 trillion in June down from ¥0.62 trillion in May. Exports gained … “Yen Mixed Despite Shrinking Trade Deficit”

Swiss Franc Flat As Trade Surplus Balloons in June

The Swiss franc is trading relatively flat against some of its currency rivals on Thursday as some recent economic data are pushing up the safe-haven asset. While not consider the global beacon of exports, Switzerland has enjoyed a significant jump last month, helping it experience the biggest trade surplus in more than two years. With Zurich engaged in terse discussions with the European Union (EU), this could … “Swiss Franc Flat As Trade Surplus Balloons in June”

Japanese Yen Mixed After Fitch Maintains Credit Rating

The Japanese yen was mixed today after Fitch Rating maintained Japan’s sovereign credit rating. The forecasts made by the agency were not all good, though. Fitch Ratings maintained Japan’s Long-Term Foreign-Currency Issuer Default Rating at ‘A’. The outlook is stable. The rating agency cited the following reasons for its decision: Japan’s ratings balance the strengths of an advanced and wealthy economy, with high governance standards and strong public institutions, … “Japanese Yen Mixed After Fitch Maintains Credit Rating”

Euro Struggles to Rally Despite Upbeat Eurozone Inflation Data

The euro today attempted to rally against the US dollar from the Asian session but encountered massive resistance despite the release of upbeat euro area inflation data. The EUR/USD currency pair could not muster enough momentum to mount a sustained rally as each attempt was quickly countered by a retracement as the bears stepped in. … “Euro Struggles to Rally Despite Upbeat Eurozone Inflation Data”

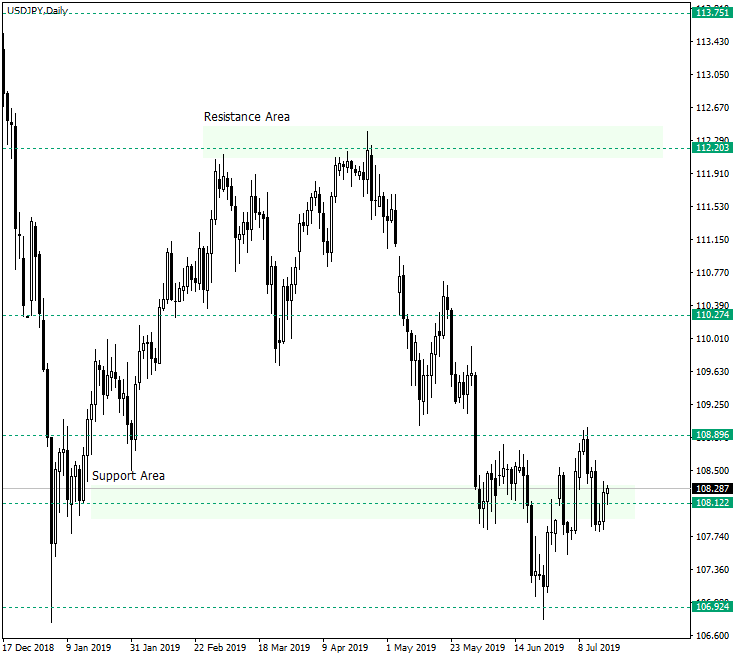

USD/JPY Possibly Preparing a New Leg Down Towards 107.00

The US dollar versus the Japanese yen might look as if it is ready for a rally, but the chart tells a different story. Long-term perspective After confirming the resistance area at 112.20, the price entered a descending phase that confirmed, on June 25, 2019, the support of 106.92, which corresponds to the psychological level of 107.00. Adding the fact that the same level was confirmed at the beginning of 2019, the price should have appreciated in a very convinced … “USD/JPY Possibly Preparing a New Leg Down Towards 107.00”

US Dollar Takes a Breather After Strong Data Sparks Rally

The US dollar is taking a breather midweek following a strong session on Tuesday, driven by strong economic data that left investors feeling ebullient. A string of housing numbers did come out, but the market did anticipate weakness in the sector, which could adjust tradersâ minds about the worldâs largest economy being on solid footing. It has been a rough year for the national real estate market, and the mortgage applications data … “US Dollar Takes a Breather After Strong Data Sparks Rally”

Canadian Dollar Mixed on Higher Auto Sales, Crashing Energy Prices

The Canadian dollar is mixed against a basket of currencies on Tuesday as investors sift through new motor vehicle sales data and foreign securities purchases for May. The loonie was sent lower on crashing energy prices, which is bad news for a resource-rich market. Traders will now wait for June inflation numbers that are expected to be lower than in May. According to Statistics Canada, new motor vehicle sales surged … “Canadian Dollar Mixed on Higher Auto Sales, Crashing Energy Prices”