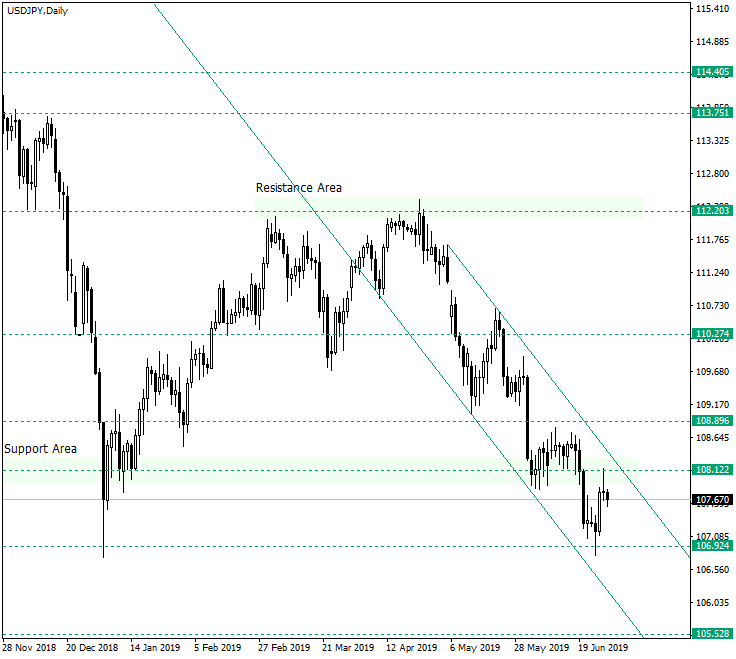

The US dollar versus the Japanese yen currency pair looks well contained into the descending trend, a context for which the bears could only be joyful for. Long-term perspective Since the end of April 2019, after the price confirmed once more the important resistance area of 112.20, the price materialized a descending trend that, until now, extended as far as 106.92 and by doing so also pierced the important support area of 108.12. Of course, … “USD/JPY Prepared to Continue the Way to 105.50”

Author: admin_mm

US Dollar Flat as USA & China Act Tough

The US dollar was mostly flat today, erasing gains and losses it posted against its rivals earlier during the trading session, as markets were somewhat directionless today. While optimism about the upcoming US-China trade talks was affecting markets, it was slowly eroding after comments made by both Chinese and US officials. US President Donald Trump put a damper on hopes for constructive trade talks, threatening … “US Dollar Flat as USA & China Act Tough”

Euro Stays Range Bound for Second Day Despite Multiple Releases

The euro today traded sideways against the US dollar reacting to releases from both the European and American dockets but failing to break out in a specific direction. The EUR/USD currency pair rallied higher in the early European session and later headed lower ignoring the upbeat German inflation data as the greenback recovered. The EUR/USD … “Euro Stays Range Bound for Second Day Despite Multiple Releases”

Swiss Franc Gains on Budget Surplus Forecast, Capped by Weak Sentiment

The Swiss franc is gaining against a basket of currencies on Thursday, supported by the governmentâs federal budget surplus forecast. As the economic powerhouse introduces tax and pension reforms, the government thinks it will take in more revenues. But the healthy state of the nationâs finances is not making investors optimistic on the economy. On Wednesday, the Swiss government introduced a draft 2020 budget, outlining a $613 million surplus. Although the government will implement reforms to taxes … “Swiss Franc Gains on Budget Surplus Forecast, Capped by Weak Sentiment”

Malaysian Ringgit Gains vs. US Dollar on Improving Economic Outlook

The Malaysian ringgit gained on the US dollar today thanks to the upgraded outlook for the nation’s economic growth. Finance Minister Lim Guan Eng said that he expects Malaysia’s economic growth to be about 5% this year. That is compared to the 4.9% increase estimated in this year’s budget, which was further revised down by the central bank in March to 4.3%-4.8%. Investments increased 3.1% in the first quarter of 2019 from the same … “Malaysian Ringgit Gains vs. US Dollar on Improving Economic Outlook”

Yen Recovers After Being Hurt by Market Sentiment, Retail Sales Match Expectations

The Japanese yen was soft today due to the positive market sentiment, which made traders less interested in safety provided by the currency. Currently, though, the yen has recovered against its major rivals, trading about flat versus most of them. Domestic macroeconomic data came out within expectations but as usual had limited impact on the currency. Markets were generally in a risk-on mode today thanks to optimism about the upcoming … “Yen Recovers After Being Hurt by Market Sentiment, Retail Sales Match Expectations”

NZ Dollar Rebounds Despite Worsening Business Confidence

The New Zealand dollar dropped initially today as the domestic business confidence worsened. But the currency rebounded later as the general market sentiment was relatively positive and supportive to riskier currencies. The ANZ Business Confidence dropped to -38.1 in June from -32.0 in May. The report talked about reasons for the decline: The outlook for the economy is murky. As things stand, there is no reason for the economy to fall into a deep hole. Commodity prices are … “NZ Dollar Rebounds Despite Worsening Business Confidence”

Mexican Peso Gains on US Dollar Ahead of Central Bank’s Meeting

The Mexican peso gained on the US dollar today ahead of tomorrow’s monetary policy meeting of Mexico’s central bank. The Bank of Mexico will announce its monetary policy decision tomorrow. Analysts expect it to keep the benchmark interest rate unchanged at 8.25%. That means focus will be on whether the bank’s statement remains as hawkish as before. USD/MXN dropped from 19.2267 to 19.1232 as of 21:44 GMT today. If you have any questions, … “Mexican Peso Gains on US Dollar Ahead of Central Bank’s Meeting”

US Dollar Mixed Under Influence of Various Fundamentals

The US dollar was mixed today, falling versus commodity currencies, but staying flat or gaining versus majors. There were plenty of various fundamentals that were affecting the greenback. Yesterday, Federal Reserve officials made comments, which suggested that the Fed does not plan to ease its monetary policy aggressively. St. Louis Federal Reserve Bank President James Bullard dismissed the idea of a 50 basis point … “US Dollar Mixed Under Influence of Various Fundamentals”

Canadian Dollar Strengthens on Wholesale Data, Energy Prices

The Canadian dollar is strengthening midweek as wholesalers recorded their fastest two-month gain in about four years and crude oil prices continued their bullish ways. The loonieâs gains were capped on the accelerating diplomatic and economic fallout between Canada and China. According to Statistics Canada, wholesale sales climbed 1.7% in April, up from 1.4% in March. This represents the fifth consecutive month of gains and is the best monthly increase in three … “Canadian Dollar Strengthens on Wholesale Data, Energy Prices”