The Japanese yen was weak for the most part today despite the better-than-expected inflation print and risk aversion among investors. Meanwhile, Japan’s manufacturing sector unexpectedly continued to contract. The Statistics Bureau reported that the Japan national core Consumer Price Index rose 0.8% in May from a year ago. While it was a little smaller than the April increase of 0.9%, it was a better reading than a 0.7% gain predicted … “Japanese Yen Soft After CPI Beats Expectations, Manufacturing PMI Misses Forecasts”

Author: admin_mm

Aussie Struggles to Keep Gains Caused by Good PMIs

The Australian dollar attempted to rally today following the release of good PMI prints. But while the Aussie managed to keep gains against some most-traded rivals, like the Japanese yen and the Great Britain pound, it reversed the rally versus others, like the US dollar and the euro. The Commonwealth Bank Flash Manufacturing PMI rose to 51.7 in June from 51.0 in May. The Commonwealth Bank Flash Services PMI climbed to 53.3 this month … “Aussie Struggles to Keep Gains Caused by Good PMIs”

Euro Weakens on Manufacturing Contraction, Falling Consumer Confidence

The euro is tumbling against its major currency rivals at the end of the trading week, driven by disappointing manufacturing activity numbers for June and an underconfident consumer. The euro has been having a tough week, especially after President Donald Trump targeted the central bank for sending the euro lower by hinting at additional monetary stimulus to support the eurozone economy. The IHS Markit Eurozone Manufacturing Purchasing Managersâ Index (PMI) clocked in at 47.8 in June, up … “Euro Weakens on Manufacturing Contraction, Falling Consumer Confidence”

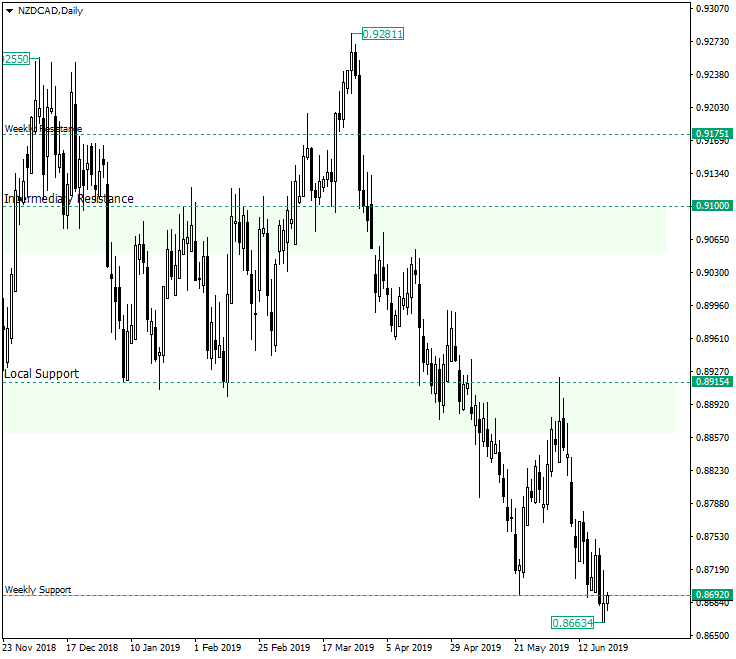

Weekly Support at 0.8692 Breached on NZD/CAD

The New Zealand dollar versus the Canadian dollar currency pair pierced a major support in the context of a well established bearish profile. Long-term perspective The price, after confirming the ex local support area at 0.8915 as resistance — which, pertaining to a consolidative phase following the rally that began on October 8, 2018, canceled the prospects of one in the near future — began a descent that tried to find support at 0.8692, but failed to. The flop in confirming … “Weekly Support at 0.8692 Breached on NZD/CAD”

US Dollar Hurt by Philly Fed Manufacturing Index, Buoyed by Jobless Claims

The US dollar is trading downwards one day after the Federal Reserve left interest rates unchanged, but the central bank leaving the door open to a future rate cut should the data support a move might be driving down the dollar. The greenback declined more on the Philadelphia Federal Reserve Bank manufacturing survey, though its descent was capped by lower-than-expected jobless claims. According to the Bureau of Labor Statistics (BLS), the number … “US Dollar Hurt by Philly Fed Manufacturing Index, Buoyed by Jobless Claims”

Canadian Dollar Attempts to Rally Following Rising Prices for Crude

The Canadian dollar attempted to rally against its major rivals today. While the currency managed to log gains against most of them, the rally was limited, and the loonie was unable to outperform the extremely strong Swiss franc. The Canadian currency gained after the news that Iran shot a US drone. While usually geopolitical tensions and resulting risk aversion hurt the loonie, the event was beneficial for crude oil, and by the same token for the Canadian … “Canadian Dollar Attempts to Rally Following Rising Prices for Crude”

Swiss Franc Strongest due to Middle East Tensions

The Swiss franc was in spotlight today, being the strongest currency on the Forex market. The reason for that was geopolitical tensions in Middle East. The reason for the franc’s extremely good performance was the news that Iran downed a US drone. Unsurprisingly, the event worsened the already strained relationships between the United States and Iran. The Swissie, being considered a safe currency, often thrives in an environment of fear and risk aversion, and that was certainly the case today. … “Swiss Franc Strongest due to Middle East Tensions”

Sterling Rallies on USD Weakness, Falls on Dovish BoE Decision

The British pound today fell from its daily highs in the mid-London session following the dovish outlook painted by the Bank of England following its rate decision. The GBP/USD currency pair had rallied to its daily highs earlier in the session by riding on the wave of broad US dollar weakness following yesterday’s dovish FOMC … “Sterling Rallies on USD Weakness, Falls on Dovish BoE Decision”

Yen Soft After BoJ Meeting, Domestic Data

The Japanese yen rose against the US dollar but fell versus most other currencies today following the monetary policy announcement from the Bank of Japan and the release of all industry activity data. As was widely expected, the BoJ left its monetary policy unchanged, with the main interest rate staying at -0.1% and the size of annual asset purchases at ¥80 trillion. Regarding the outlook for the domestic economy the central bank said: … “Yen Soft After BoJ Meeting, Domestic Data”

Aussie Mixed After Lowe Talks About Interest Rate Cuts

The Australian dollar was mixed today, falling against some rivals and rising versus others. The Aussie remained vulnerable due to prospects for additional interest rate cuts from the Reserve Bank of Australia. RBA Governor Philip Lowe said in a speech today that additional interest rate cuts are possible: The most recent data â including the GDP and labour market data â do not suggest we are making … “Aussie Mixed After Lowe Talks About Interest Rate Cuts”