The Bank of England has not changed its policy but has expressed several concerns. These concerns comprise of baby steps towards removing the hawkish bias and weigh on the pound. GBP/USD faces several support levels on the way down. The Bank of England has been moving towards the dovish side, beginning to align itself with its peers. … “5 dovish moves by the BOE that send GBP/USD down”

Author: admin_mm

NZ Dollar Rallies as Economic Growth Remains Stable

The New Zealand dollar rallied today after a report showed that nation’s economic growth remained stable. Statistics New Zealand reported that gross domestic product rose 0.6% in the March quarter from the previous three months. It was the same pace of growth as in the previous quarter and matched forecasts exactly. On an annual basis, GDP grew 2.7%. NZD/USD surged from 0.6537 to 0.6587 as of 10:29 GMT today. NZD/JPY gained … “NZ Dollar Rallies as Economic Growth Remains Stable”

Norwegian Krone Soars After Norges Bank Hikes Interest Rate

The Norwegian krone surged today after the nation’s central bank announced an interest rate hike and signaled about probability of additional hikes in the future. The Norges Bank announced today that it raises its main interest rate by 0.25 percentage point to 1.25 percent. The bank commented on the decision: Growth in the Norwegian economy is solid, and capacity utilisation is estimated to be somewhat above a normal level. Underlying inflation is a little … “Norwegian Krone Soars After Norges Bank Hikes Interest Rate”

BOE may join the gang and go dovish, weighing on the pound

The BOE has been holding up its intention to raise interest rates. Uncertainty about Brexit and global headwinds may push the pound back to neutral. GBP/USD is vulnerable ahead of the decision. The world’s most prominent central banks have turned dovish – and it may the Bank of England’s turn now. The BOE has been forecasting rate … “BOE may join the gang and go dovish, weighing on the pound”

Euro Soft as Domestic Data Hurts

The euro was soft today. While the currency managed to gain on the US dollar thanks to the dovish Federal Reserve, unfavorable domestic macroeconomic data prevented the euro from rising against other most-traded rivals. The German Producer Price Index fell 0.1% in May from the previous month. That is compared to the median forecast of a 0.2% increase and the 0.5% gain registered in April. The eurozone current account surplus shrank to â¬21 billion in April … “Euro Soft as Domestic Data Hurts”

Canadian Dollar Rises Sharply as Consumer Inflation Beats Expectations

The Canadian dollar was firm today after nation’s consumer inflation accelerated and beat analysts’ expectations. The rally of crude oil prices likely also helped the currency. Statistics Canada reported that the Consumer Price Index rose 2.4% in May, year-over-year, after rising 2.0% in April. The gains were broad-based, including higher prices for food and durable goods, while prices for gasoline declined. Month-on-month, the index was up 0.4%, without … “Canadian Dollar Rises Sharply as Consumer Inflation Beats Expectations”

US Dollar Mixed on Dovish, Optimistic Federal Reserve

The US dollar was mixed against its major rivals midweek as analysts and investors are trying to make heads and tails of the Federal Reserve‘s latest policy announcement. The US central bank left interest rates unchanged, but it confirmed that it will “closely monitor” the numbers to determine if rates need to be lowered. Despite the dovish signals, Fed officials are still optimistic about the US economy, sticking … “US Dollar Mixed on Dovish, Optimistic Federal Reserve”

3 reasons why the USD can recover after the Fed’s blow

The Federal Reserve has left rates unchanged but downgraded its language. There are three reasons why the USD retreated on the news. But there are also three factors that could send it back up. The Federal Reserve has left the interest rates unchanged as broadly expected but has also made significant changes that open the door to … “3 reasons why the USD can recover after the Fed’s blow”

Pound Rallies After UK Inflation Meets Consensus Estimates

The British pound today rallied higher in the early London session following the release of the latest UK inflation data, which was in line with consensus estimates. The GBP/USD currency pair extended yesterday’s gains and rallied into the American session to print new weekly highs driven by positive investor sentiment. The GBP/USD currency pair today rallied from a low of 1.2541 in the early London session … “Pound Rallies After UK Inflation Meets Consensus Estimates”

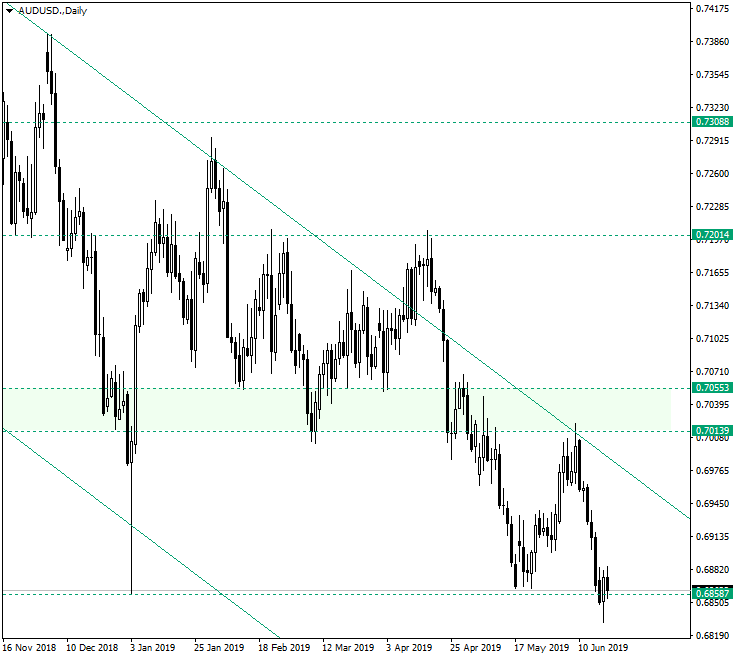

AUD/USD After Reaching 0.6858

The Australian dollar versus the US dollar hits the first target, at 0.6858. The upcoming move could be very interesting. Long-term perspective The pair confirmed the important resistance made up by the zone limited in between 0.7055 and 0.7013 and the upper trendline of the descending channel. The confirmation resulted in a decline that reached the major support of 0.6858, which constitutes the first target for the current impulsive wave that the decline represents. The price could print a minor correction, … “AUD/USD After Reaching 0.6858”