The US Dollar index was flat today as the greenback was somewhat directionless during the trading session. Overall though, fundamentals looked really negative for the US currency, meaning that it has room for downside. The US Bureau of Labor Statistics reported that the seasonally adjusted Producer Price Index rose 0.1% in May. While the reading was within market expectations, it was a slowdown from the April’s 0.2% growth. In fact, … “US Dollar Flat Following Release of US PPI”

Author: admin_mm

Euro Firm After Slump of Eurozone Investor Confidence

The euro was relatively firm today following the release of unexpectedly poor eurozone investor confidence print. While the shared 19-nation currency fell versus some of stronger rivals, like the Great Britain pound, it managed to gain on many other most-traded counterparts. The Sentix investor confidence for the eurozone slumped from 5.3 to -3.3 in June. Analysts were expecting a far better figure of 2.3. The report blamed the resumption of trade wars for the slump: … “Euro Firm After Slump of Eurozone Investor Confidence”

Norwegian Krone Declines as Inflation Slows

The Norwegian krone declined today after nation’s inflation slowed unexpectedly last month. Statistics Norway reported that consumer inflation slowed from 2.9% in April to 2.5% in May — the lowest level in a year. Core inflation slowed from 2.6% to 2.3% — the lowest since January. Ahead of the report, analysts had predicted both indicators to stay unchanged. USD/NOK slipped from 8.6537 to 8.6483 as of 8:34 GMT today after rallying to the daily … “Norwegian Krone Declines as Inflation Slows”

Aussie Falls Despite Positive Market Sentiment, Domestic Data Doesn’t Help

The Australian dollar remained soft today, extending yesterday’s decline against many rivals. The Australian currency, together with its New Zealand counterpart, was moving in opposition to the general market sentiment, which was positive and supportive to riskier currencies. Mixed domestic macroeconomic data was not helping the Aussie. National Australia Bank reported that business conditions fell from +3 to +1 in May. In contrast, business confidence rose … “Aussie Falls Despite Positive Market Sentiment, Domestic Data Doesn’t Help”

Sterling Falls on Weak UK Data As Tory Leadership Contest Heats Up

The Sterling pound today fell almost to one-week lows after the release of a raft of disappointing macro data from the UK docket such as the April GDP print. The GBP/USD currency pair remains under pressure as the Conservative Party‘s search for a successor to the outgoing Prime Minister Theresa May officially kicks off. The GBP/USD currency pair today fell from an opening high of 1.2728 in the Asian session to a low of 1.2653 … “Sterling Falls on Weak UK Data As Tory Leadership Contest Heats Up”

Chinese Yuan Weakens As Forex Reserves, Exports Unexpectedly Rise

The Chinese yuan is weakening to kick off the trading week as the nationâs foreign exchange reserves and exports unexpectedly rose in May. With the balance of trade numbers being higher than what the market had anticipated, it might play a role in the US-China trade war, which is dragging out and could linger into the holiday season. According to the Peopleâs Bank of China (PBOC), Beijingâs foreign exchange reserves increased by $6 billion … “Chinese Yuan Weakens As Forex Reserves, Exports Unexpectedly Rise”

Australian Dollar Soft After China’s Trade Surplus Grows

The Australian dollar was extremely weak against its most-traded peers today after China’s trade surplus rose much more than was expected. China’s trade balance logged a surplus of $41.66 billion in May, up from $23.42 billion in April, demonstrating the largest surplus since December of the last year. Exports rose 1.1%, year-on-year, but experts explained that by rush of companies to ship goods before the US tariffs … “Australian Dollar Soft After China’s Trade Surplus Grows”

GBP/USD may extend its falls on the UK jobs report

The pound has been suffering from a poor GDP read for April. A bitter disappointment in the same month’s jobs report may be on the cards. GBP/USD may be unprepared for this outcome, potentially extending its falls. UK economic output has already been hit from Brexit uncertainty – and the job market may suffer the … “GBP/USD may extend its falls on the UK jobs report”

Mexican Peso Trades Sharply Higher After Trade Starts

The Mexican peso traded sharply higher today after Monday’s trade started. The currency gained on the news that the United States and Mexico managed to reach a deal that will allow to avoid a tariff war. Previously, the peso was extremely weak after US President Donald Trump dropped a bomb on markets, announcing that he is planning to implement tariffs on Mexican goods unless Mexico takes measures to curb illegal migration. … “Mexican Peso Trades Sharply Higher After Trade Starts”

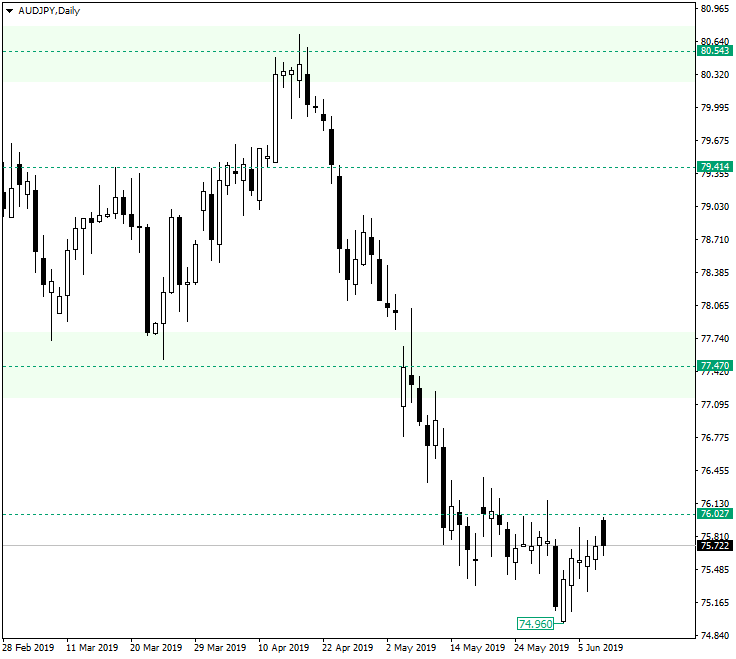

AUD/JPY Might Revisit 74.96

As the bulls tried to conquer the 76.02 level, the bears managed to turn the appreciation in their favor, causing a descent that can be considered a confirmation of the level as a resistance. Long-term perspective The Australian dollar versus the Japanese yen currency pair was engaged in a descent that was very well driven by the sellers. After confirming the level of 80.54 as resistance, the price fell under the just pierced resistance of 79.41, and thus the fail to confirm the latter level … “AUD/JPY Might Revisit 74.96”