The Australian dollar sank today, leading the decline among riskier commodity currencies, as the market sentiment deteriorated amid escalating trade tensions between China and the United States. Domestic macroeconomic data was not helpful to the Aussie either. The Australian Bureau of Statistics reported that the total seasonally adjusted number of home loans dropped by 2.5% in March from the previous month. That is instead of rising 2.2% as analysts had predicted. But … “Aussie Sinks as US-China Trade Tensions Sour Market Sentiment”

Author: admin_mm

Euro Rallies on Chinaâs Retaliatory Measures, Drops Shortly After

The euro today leapt to new monthly highs against the US dollar after news reports suggested that China was planning retaliatory tariffs on US exports. According to the Guardian, China is set to implement a 25% tariff on $60 billion worth of US imports as well as halting bond purchases among other measures. The EUR/USD currency pair today rallied from a … “Euro Rallies on Chinaâs Retaliatory Measures, Drops Shortly After”

3 reasons for the dollar’s fall on China’s retaliation

China is retaliating with tariffs and threats of taking further measures The greenback is falling sharply against majors. There are three reasons for the fall of the USD. The US Dollar has sunk after China announced launched its torpedo countermeasures in retaliation to the new US tariffs. So far, the ongoing negotiations provided hopes that it … “3 reasons for the dollar’s fall on China’s retaliation”

UK wages and unemployment are unlikely to rock the pound

GBP/USD struggles with 1.3000, not going anywhere fast. Brexit continues tearing Britain’s main parties apart and talks are closer to breaking up. The technical outlook leans to the downside for the currency pair. Nigel Farage’s new Brexit party will receive more votes than the Conservatives and Labour combined in the upcoming European elections, according to a weekend … “UK wages and unemployment are unlikely to rock the pound”

US Dollar Outlook for Week of May 13-17, 2019

The US dollar ended the previous trading week relatively soft as markets were digesting the news that the United States decided to implement tariffs on Chinese goods. The developments in the trade negotiations between the world’s two biggest economies are likely to affect the greenback during the current trading week, though US macroeconomic data can have its impact as well. It seemed that the USA and China were close to reaching a trade deal, … “US Dollar Outlook for Week of May 13-17, 2019”

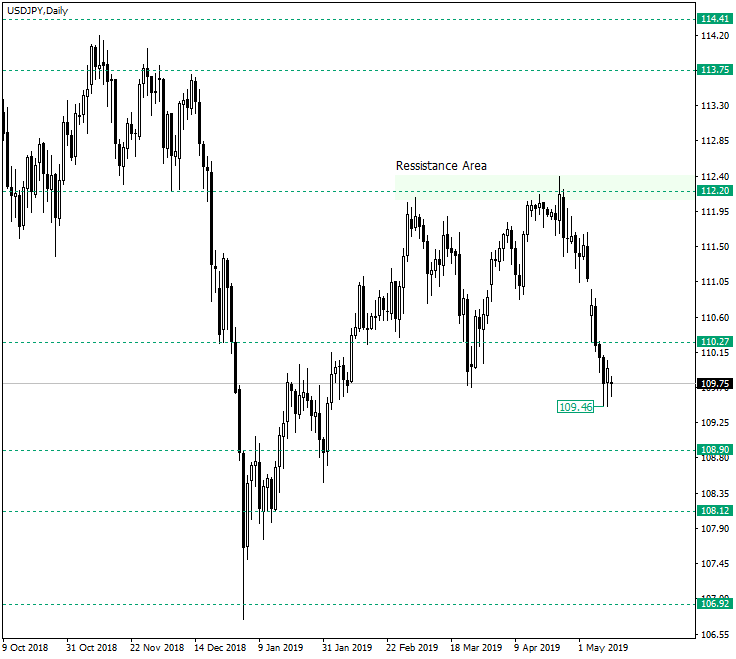

One Last Chance for the Bulls on USD/JPY

Under the 110.27 support area and still with an overall bullish bias, the US dollar versus the Japanese yen currency pair has what it takes for yet another upwards move. Long-term perspective After the decline etched by the confirmation of 112.20 as resistance on April 24, 2019, the price pierced the first major support at 110.27 and made a new low — at least for the time being — at 109.46. Of course, one could say that after such … “One Last Chance for the Bulls on USD/JPY”

Cryptos: What’s next after the Sunday surge?

Cryptocurrencies have shot higher over the weekend as more money pours in. Bitcoin jumped by around $1,000 and the others also pushed higher. Here are the levels to watch according to the Confluence Detector. The Tether scandal may belong to the past, at least according to recent price action. Digital coins are not constrained by … “Cryptos: What’s next after the Sunday surge?”

Canadian Dollar Jumps on Stellar Employment Data

The Canadian dollar climbed on Friday after employment data demonstrated a shockingly good result for April. The disappointing housing report had hardly any impact on the currency. Statistics Canada reported that the number of employed people jumped by as much as 106,500 in April from the previous month, almost ten times the forecast amount of 11,700! The notable gains were in part-time work for youth. Furthermore, the unemployment rate ticked down unexpectedly from 5.8% to 5.7%. … “Canadian Dollar Jumps on Stellar Employment Data”

US Dollar Mixed As Tariffs on Chinese Goods Go Into Effect

The US dollar is surging against some currencies and sliding against others at the end of the trading week as tariff hikes on Chinese imports went into effect. With inflation meeting market expectations, investors are focused more on another hiccup in the US-China trade war deliberation, which may linger into the summer and cause market strife. On Friday, US tariffs on $200 billion in Chinese goods rose from 10% to 25% after … “US Dollar Mixed As Tariffs on Chinese Goods Go Into Effect”

Is it time to buy the dollar? The post-inflation fall does not seem warranted

April’s inflation numbers show core inflation accelerated to 2.1% as expected That should enough for the Fed to sit on its hands and refrain from rate cuts. The greenback may recover from and even extend its gains after the light drop. US core consumer prices are accelerating once again. They have edged up from 2% … “Is it time to buy the dollar? The post-inflation fall does not seem warranted”