Spaniards go to the polls on Sunday and polls show a divided country. The various political scenarios may take time to materialize. EUR/USD may enjoy the results, but it will take time. Citizens of the fourth-largest economy in the euro-zone vote in general elections on Sunday, April 28th. Voting ends at 18:00 GMT. Exit polls … “5 scenarios for Spain’s elections”

Author: admin_mm

USD/JPY has room to fall on a paralyzed BOJ

The BOJ is set to leave its policy unchanged at the sixth anniversary of its QQE program. There is little maneuvering space for the central bank. The Japanese yen could strength on the inability to act. The Bank of Japan announces its rate decision and releases its Outlook for Economic Activity and Prices in the … “USD/JPY has room to fall on a paralyzed BOJ”

Chinese Yuan Weakens Despite Positive Outlook, Continued Stimulus

The Chinese yuan is sliding against some of its most traded currency pairs on Monday. As the yuan weakens, there is a positive outlook for the Chinese economy on the market, particularly as Beijing confirming that it will continue to support its economy. Industrial metals steel and iron ore soared on Monday after the federal government announced it would maintain stimulus support for the worldâs second-largest economy. The Communist Party said it would … “Chinese Yuan Weakens Despite Positive Outlook, Continued Stimulus”

Norwegian Krone Follows Crude Oil in Rally

The Norwegian krone gained today as the rally of crude oil boosted currencies of oil exporting nations. The Norway’s currency rallied today for the same reason as the Canadian dollar — the sharp rise of crude oil prices. Norway exports crude oil, therefore it was positive news for the nation’s currency. There are concerns, though, that risk aversion can hurt risk-sensitive commodity currencies, including the krone and the loonie. USD/NOK slipped from 8.5127 … “Norwegian Krone Follows Crude Oil in Rally”

Canadian Dollar Rises with Crude Oil, Gains Capped by BoC Worries

The Canadian dollar gained against other most-traded currencies today thanks to a big rally of crude oil. But gains were limited as market participants were waiting for the monetary policy decision of Canada’s central bank later this week. According to a report from Washington Post, today the United States will announce an end of Iran sanctions waivers. The USA implemented sanctions against the Middle Eastern nation some time ago but … “Canadian Dollar Rises with Crude Oil, Gains Capped by BoC Worries”

USD/SEK Edges Higher Ahead of This Week’s Riksbank Meeting

The Swedish krona fell against the US dollar a bit today ahead of this week’s monetary policy meeting of Sweden’s central bank. The Riksbank will hold a monetary policy meeting on Thursday. While market participants do not expect changes to interest rates, they will watch the accompanying press conference for hints about the central bank’s plan. Another important event will be the release of the Producer Price Index and retail sales data … “USD/SEK Edges Higher Ahead of This Week’s Riksbank Meeting”

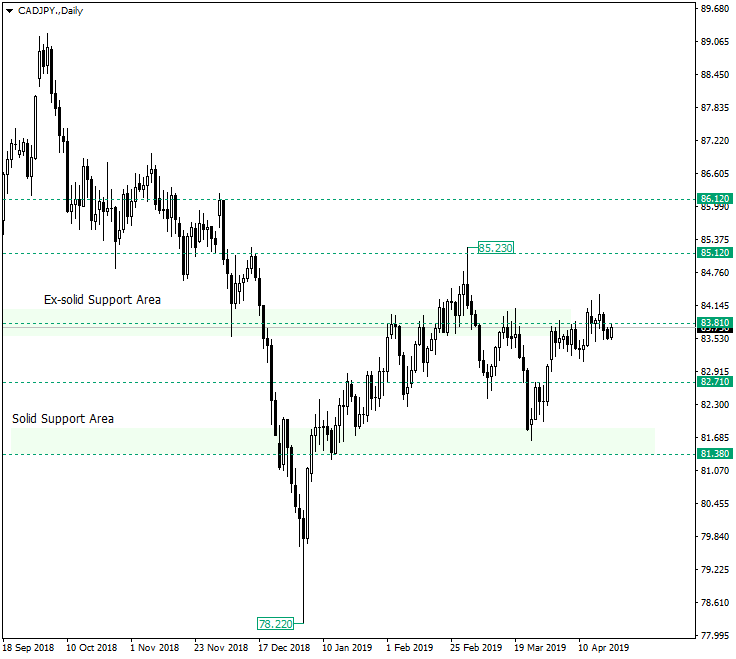

CAD/JPY Trying to Keep Things on Track

The Canadian dollar versus the Japanese yen is testing the important ex-solid support area of 83.81. Long-term perspective After bouncing from the currently solid support area of 81.38 on March 25, 2019, the price managed to surpass the 82.71 intermediary level and extend just under 83.81. There it entered a consolidation phase that lasted until almost the middle of April, on April 12, 2019, the price attempting to break the bearish barrier at 83.81 … “CAD/JPY Trying to Keep Things on Track”

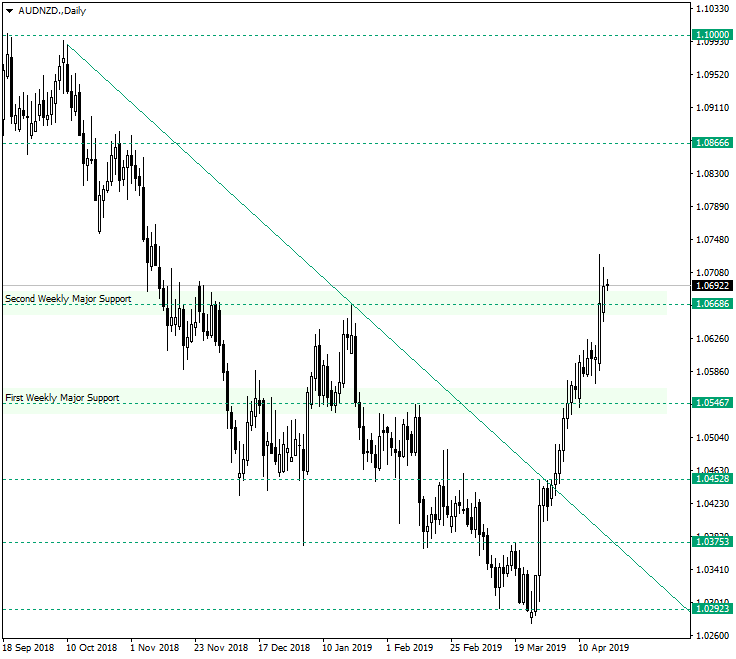

After the Strong Appreciation on AUD/NZD

The Australian dollar versus the New Zealand dollar etched the new high of 2019, and this makes possible even more positive expectations. Long-term perspective The strong descending trend that started on October 2018 and extended until the end of March 2019 looks like it is really over. The April 2, 2019, piercing of the double resistance area established by the convergence of the resistance of the descending trend with the 1.0452 level advanced without looking … “After the Strong Appreciation on AUD/NZD”

Loonie Shows Mixed Performance Despite Strong Retail Sales

The Canadian dollar showed mixed performance today despite favorable retail sales data. The explanation for this could be strength of its rivals as well as the decline of crude oil prices. Statistics Canada reported that retail sales rose 0.8% in February from the previous month on a seasonally adjusted basis following three consecutive monthly declines. Analysts had predicted a smaller increase by 0.4%. Core retail sales (sales excluding important … “Loonie Shows Mixed Performance Despite Strong Retail Sales”

Australian Dollar Mixed Despite Stellar Employment Data

The Australian dollar was mixed today despite extremely positive employment data. Other macroeconomic reports released in Australia during the Thursday’s trading session were less stellar. The Australian Bureau of Statistics reported that employment grew by 25,700 in March from the previous month after rising by 10,700 in February. Analysts had expected a smaller increase by 15,200. The increase was result of a gain in full-time employment by 48,300, while part-time employment decreased … “Australian Dollar Mixed Despite Stellar Employment Data”