The Mexican peso is rising against several currencies at the end of the trading week. The pesoâs recent rally comes as President Donald Trump threatened to close the border, a move that many have estimated would cost both countries billions of dollars in lost commerce. On the domestic front, the federal government plans to curb spending amid slower economic growth and falling crude oil production, leaving financial analysts with the impression that the country … “Mexican Peso Strengthens Amid Trumpâs Border Shutdown Threat”

Author: admin_mm

NFP is good enough for the dollar, not only for stocks

The US economy returned to normal job growth and lower wage growth. The “Goldilocks” report may be gold for the US Dollar. The US gained a net of 196K jobs in March. This is a return to normal levels after a dismal number in February (33K after an upwards revision) and superb numbers beforehand. The return … “NFP is good enough for the dollar, not only for stocks”

US Dollar Volatile After Nonfarm Payrolls

The US dollar demonstrated extremely volatile reaction to nonfarm payrolls, falling then rebounding immediately. As it was usual lately, the employment report did not produce a clear picture of the US labor market, having both good and bad parts. On one hand, the report from the Bureau of Labor Statistics showed an increase of employment by healthy 196,000 in March, which was above the consensus forecast of 172,000. The February abysmal figure of 20,000 got … “US Dollar Volatile After Nonfarm Payrolls”

Japanese Yen Moves Sideways, Economic Data Gives No Direction

The Japanese yen traded sideways today as markets were lying in wait for US nonfarm payrolls. Domestic macroeconomic data was somewhat mixed, giving the Japanese currency no direction. Japan’s Cabinet Office reported that the leading index rose to 97.4% in February from 96.5% in January, in line with expectations. The Statistics Bureau reported that household spending increased by 1.7% in February over a year versus the forecast of a 1.9% increase and the 2.0% … “Japanese Yen Moves Sideways, Economic Data Gives No Direction”

Australian Dollar Flat After Macroeconomic Data

The Australian dollar traded about flat today after the release of positive macroeconomic data. Traders were reluctant to make big bets ahead of very important US nonfarm payrolls. The seasonally adjusted Australian Industry Group/Housing Industry Association Australian Performance of Construction Index rose to 45.6 in March from 43.8 in February. While the index remained below the neutral 50.0 level, indicating contraction of the sector, the higher figure meant that the decline … “Australian Dollar Flat After Macroeconomic Data”

Euro Rallies on German Industrial Data, Later Trades Sideways

The euro today rallied higher following the release of German industrial production data in the early European session as the print beat expectations. The EUR/USD currency pair later traded sideways amid a lack of any fundamental triggers as investors waited for the non-farm payrolls report. The EUR/USD currency pair today rallied from an opening low … “Euro Rallies on German Industrial Data, Later Trades Sideways”

USD/CAD: The Canadian jobs report has room to lift CAD

After a winning streak of Canadian jobs reports, expectations are low this time. Alongside the risk-on atmosphere, the Canadian Dollar has room to rise. The US Non-Farm Payrolls could complicate the price action. Canada publishes its labor market report for March on April 5th, at 12:30 GMT. The nation enjoyed a winning streak of surprisingly strong … “USD/CAD: The Canadian jobs report has room to lift CAD”

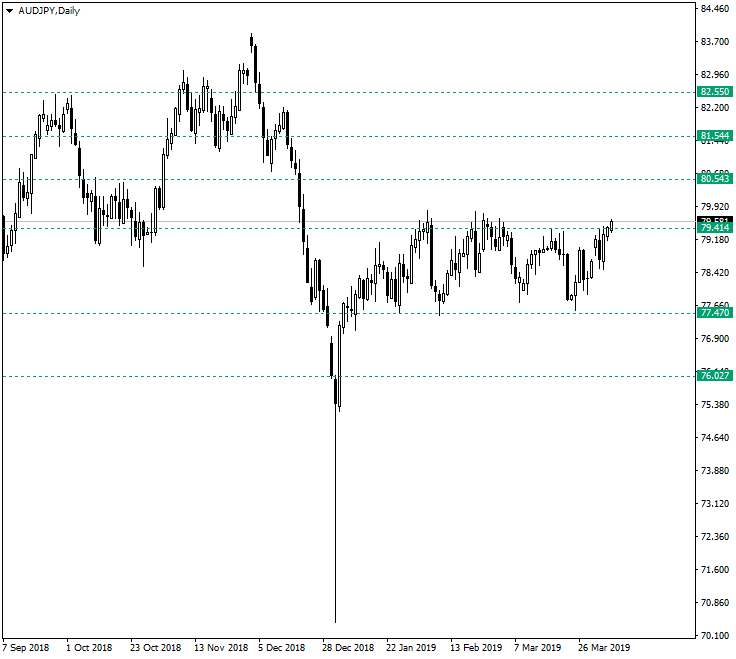

AUD/JPY Again at the Edge of the Flat

The Australian dollar vs. Japanese yen is developing at the resistance area where all the peaks of 2019 had formed. Of course, what will it do this time is the most interesting part of all. Long-term perspective Since the second half of January 2019, the pair evolves in a flat limited by 77.47 as support and 79.41 as resistance. Even thought the retracements from the support are fairly strong, the resistance manages to decrease the volatility of the price … “AUD/JPY Again at the Edge of the Flat”

7 reasons for the crypto surge and why it can continue

Cryptocurrencies have surged and held onto most of their gains. There are seven reasons behind the move that caught some by surprise. There are good reasons to believe the rally will continue. Bitcoin has not seen the $5,000 mark since November 2018, and now it happened. Ethereum also enjoyed a rally and even Ripple eventually advanced. The leap initially seemed … “7 reasons for the crypto surge and why it can continue”

Japanese Yen Struggles for Direction Amid Mixed Data

The Japanese yen is mixed against a handful of currency rivals on Thursday as a plethora of recent data could not prove the national economy was expanding or contracting. Policymakers also delved into the latest Modern Monetary Theory (MMT) proposal that is gaining steam in the US. According to the Bank of Japan (BOJ), economic output exceeded its full capacity in the fourth quarter last year by the most in nearly three decades. The central bank … “Japanese Yen Struggles for Direction Amid Mixed Data”