The New Zealand dollar rallied today, lifted by positive news from China. China’s service sector expanded more than was expected, while rumors circulated that the United States and China are close to a trade deal. The Caixin China Services PMI climbed from 51.1 in February to 54.4 in March. That is compared to the average forecast of an increase to just 52.3. As for economic data in New Zealand itself, there were just … “NZ Dollar Gets Lifted by Positive News from China”

Author: admin_mm

7 reasons for the cryto rally and where Bitcoin could go next

Cryptocurrencies have surged and held onto most of their gains. There are seven reasons behind the move that caught some by surprise. There are good reasons to believe the rally will continue. Bitcoin has not seen the $5,000 mark since November 2018, and now it happened. Ethereum also enjoyed a rally and even Rippleeventually advanced. The leap initially seemed … “7 reasons for the cryto rally and where Bitcoin could go next”

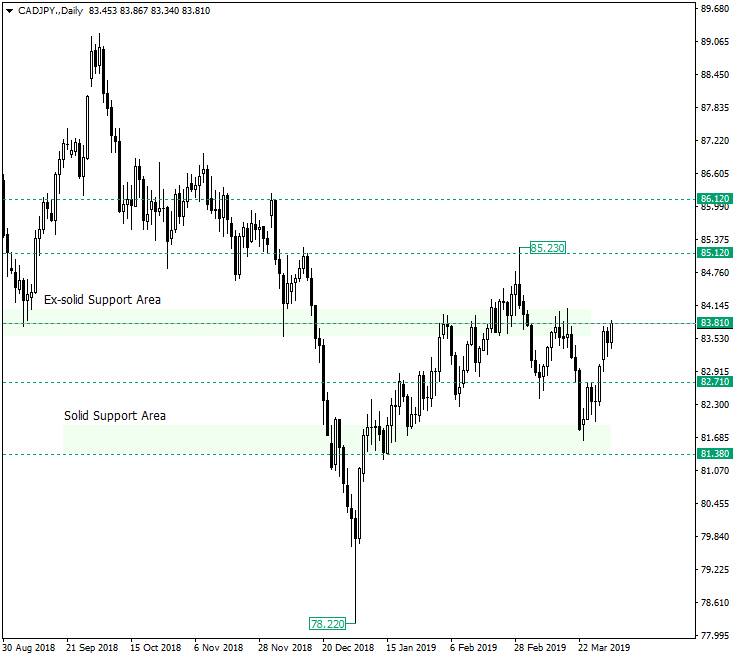

Big Test for Canadian Dollar vs. Japanese Yen

On CAD/JPY, the price managed to rally to an area which not only served as a solid support in the second half of 2018, but also primed as an important boundary since the earliest times of the pair. Long-term perspective After the retracement from 78.22 at the beginning of 2019, the price prevailed in reconquering, in two months, two important support areas: 81.38 and 83.81, respectively. Because of this achievement, the profit-taking phase which followed caused a drop from 85.23 that … “Big Test for Canadian Dollar vs. Japanese Yen”

Chinese Yuan Weakens Despite Bullish Manufacturing Data

The Chinese yuan is weakening against some of its currency rivals on Tuesday, despite a myriad of data that suggests the economy might be rebounding as the year progresses. Should investors be optimistic, or should they maintain a modicum of skepticism? Last month, the manufacturing sector experienced a surprise return to growth, buoyed by the federal governmentâs efforts to stimulate the economy. The Caixin/Markit Manufacturing Purchasing Managersâ Index (PMI) increased to 50.8 in March, beating the median … “Chinese Yuan Weakens Despite Bullish Manufacturing Data”

Euro Trades Sideways on Data Divergence, Falls on Dollar Rally

The euro today traded sideways against the US dollar amid a mixed market mood as investors weighed the data divergence between the EU and the US. The EUR/USD currency pair later broke out of its sideways range in the American session as the US dollar recovered. The EUR/USD currency pair today traded in a range … “Euro Trades Sideways on Data Divergence, Falls on Dollar Rally”

GBP/USD could struggle on non-Brexit news for a change – Services PMI

Markit’s Services PMI will provide a snapshot of how businesses are feeling about Brexit. Data usually has a short-lived effect when Brexit is left, right, and center. GBP/USD may drop if the data disappoint. Markit releases its Purchasing Managers’ Indicator for the Services sector on Wednesday, April 3rd, at 8:30 GMT. The sector is the … “GBP/USD could struggle on non-Brexit news for a change – Services PMI”

US Dollar Rallies on Strong Manufacturing, Construction Spending

The US dollar is rallying against some of the most-traded currency pairs to kick off the trading week. The greenback is finding direction on recent data that suggest that the current bull run still has some legs and the economy could have additional room to grow. The buck was capped as traders had a renewed interest in China after a swath of data were released showing perhaps a recovery is in sight. According to the Census … “US Dollar Rallies on Strong Manufacturing, Construction Spending”

Will Parliament vote for the Norwegian Model? GBP/USD has room to the upside

The UK Parliament will hold a second round of Indicative Votes 2.0. A soft version of Brexit can win after Labour threw its support behind it. GBP/USD can rally, even if this is a non-binding vote. Parliament may finally say yes and Speaker John Bercow may finally announce “the Ayes have it.” The second series … “Will Parliament vote for the Norwegian Model? GBP/USD has room to the upside”

ISM Manufacturing PMI could reflect fear, but might help the USD

The ISM Manufacturing PMI is expected to edge up in March. The data is forward-looking for the industry and a hint towards the NFP. The US Dollar may gain a disappointment and fall on an upbeat number. The ISM Manufacturing Purchasing Managers’ Index for March is published on Monday, April 1st, at 14:00. The indicator … “ISM Manufacturing PMI could reflect fear, but might help the USD”

Positive Chinese Reports & Negative Domestic Data Send Japanese Yen Lower

The Japanese yen opened sharply lower and proceeded to fall against all other most-trade currencies, emerging as the weakest currency on the Forex market today. While the main reason for the drop was risk appetite caused by positive macroeconomic reports in China, domestic macroeconomic data did not do any good to the Japanese currency either. Japan’s Tankan large manufacturing index dropped from 19 in the fourth quarter of 2018 to 12 in the first quarter … “Positive Chinese Reports & Negative Domestic Data Send Japanese Yen Lower”