The Sterling pound today crashed to new lows during a speech by Bank of England Governor Mark Carney regarding the bank’s interest rate decision. The GBP/USD currency pair had traded in a consolidative phase following the release of UK construction industry data before the BoE rate decision. The GBP/USD currency pair today crashed from an … “Sterling Pound Crashes on Dovish Carney Speech After BoE Rate Hike”

Author: admin_mm

Widening Trade Surplus Does Not Prevent Aussie’s Drop

Australia’s trade balance increased more than was expected, but that did not prevent the Australian dollar from falling. The likely reason for the currency’s drop was the risk-negative sentiment on the Forex market. The Australian Bureau of Statistics reported that the trade surplus widened to A$1.87 billion in June (seasonally adjusted) from the negatively revised A$0.73 billion in May. Experts were anticipating a much smaller increase to just A$0.91 billion. Yet … “Widening Trade Surplus Does Not Prevent Aussie’s Drop”

Japanese Yen Rallies As US-China Trade Conflict Heats Up

The Japanese yen rallied today as US-China trade tensions suddenly flared up, driving market participants to seek safety. Risk aversion on the Forex market heightened after the news that the United States were considering additional tariffs on Chinese goods. The yen traditionally thrives in risk-negative environment. Tomorrow, the Bank of Japan will release a policy meeting minutes, but they will be for the June meeting, not the latest one, therefore will … “Japanese Yen Rallies As US-China Trade Conflict Heats Up”

Japanese Yen Plunges As BOJ Maintains Ultraloose Monetary Policy

The Japanese yen continued to plummet against the US dollar and a basket of other currencies. After the Bank of Japan (BOJ) maintained its ultraloose monetary policy, surprising international markets, the currency continued its sluggish performance over the last five trading sessions. On Tuesday, the BOJ decided to only modify its yield curve control policy, refraining from diminishing its accommodative policies that have been in place since the financial crisis … “Japanese Yen Plunges As BOJ Maintains Ultraloose Monetary Policy”

Euro Rallies Against US Dollar Despite Positive ADP Jobs Report

The euro today rallied slightly against the US dollar recovering most of its initial losses against the greenback in the early to mid-European sessions. The EUR/USD currency pair rallied higher in the early American session despite the release of the positive US ADP employment report. The EUR/USD currency pair rallied from a low of 1.1671 … “Euro Rallies Against US Dollar Despite Positive ADP Jobs Report”

British Pound Reverses Losses and Rallies on Positive Housing Data

The British pound today reversed its losses against the US dollar and rallied higher from the early European session following the release of positive UK housing data. The GBP/USD currency pair extended its rally into the mid-European session despite the release of disappointing UK Manufacturing PMI data by IHS Markit shortly thereafter. The GDP/USD currency … “British Pound Reverses Losses and Rallies on Positive Housing Data”

Canadian Dollar Reverses Losses After GDP Beats Expectations

The Canadian dollar rallied today, reversing its earlier losses. The currency got a boost from Canada’s solid economic growth. Statistics Canada reported that gross domestic product rose 0.5% in May after increasing 0.1% in April. Analysts had predicted a smaller increase by 0.3%. In June, both the Industrial Product Price Index and the Raw Materials Price Index also rose 0.5%, though in this case the rate of growth significantly … “Canadian Dollar Reverses Losses After GDP Beats Expectations”

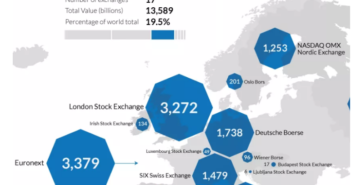

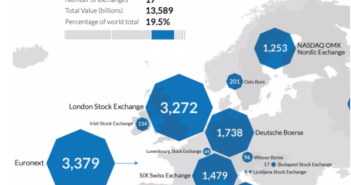

MiFID 2.1 – How Will Brexit Change the Rules?

Brexit, the official withdrawal of the United Kingdom from the European Union, kicked off on March 29, 2017, with two years set to “B-Day” on March 29, 2019. Over 50% of the British public voted to leave the EU in a referendum with a turnout exceeding 72%. But could this move affect the financial markets … “MiFID 2.1 – How Will Brexit Change the Rules?”

MiFID 2.1 – How Will Brexit Change the Rules?

Brexit, the official withdrawal of the United Kingdom from the European Union, kicked off on March 29, 2017, with two years set to “B-Day” on March 29, 2019. Over 50% of the British public voted to leave the EU in a referendum with a turnout exceeding 72%. But could this move affect the financial markets … “MiFID 2.1 – How Will Brexit Change the Rules?”

Turkish Lira Declines After Central Bank Upgrades Inflation Forecast

The Turkish lira fell today after Turkey’s central bank revised its inflation forecast up. The currency declined even as the bank signaled about possibility of an interest rate hike. The Central Bank of the Republic of Turkey released the Summary of the Monetary Policy Committee Meeting for the last week’s policy meeting. After the gathering, the bank surprised markets, refraining from increasing borrowing costs to tame accelerating inflation. In the today’s notes, the central bank revealed … “Turkish Lira Declines After Central Bank Upgrades Inflation Forecast”